Time Editorial Department | Time Jun is a person who loves movies. Recently, the 36th China Golden Rooster Award and the 24th National Film Promotion Conference have come to an end. These two grand gatherings of filmmakers of the year also brought a large number of newly exposed domestic new films. Today, Time Jun took stock of 15 blockbuster new films with strong lineup and much attention. For example, Wandering Earth 3 directed by Frant Gwo, Sauce Garden Lane directed by Chen Kexin and starring Zhang Ziyi, Plan P led by Jackie Chan, Decryption directed by Chen Sicheng, Dog Array directed by Guan Hu and so on. It is expected that in next year or the year after, these new works will become new explosions and once again ignite the domestic film market.

Wandering earth 3

Director: Frant Gwo

Starring: Jason Wu/Li Xuejian/Andy Lau/Tong Liya/Wang Zhi

Release date: February 6, 2027

The Wandering Earth’s first two box office word-of-mouth double harvest, the high-profile "Wandering Earth 3" officially announced the release on the first day of 2027.

The story content of the new work is still unknown. In the poster picture, the city is in ruins, and the surrounding area has become ruins. The once towering planetary engine has become wreckage after being attacked.

The poster is full of eschatology, which also indicates the crisis of sequel.

Preview of Wandering Earth 3

In a few new shots exposed in the preview, actors Li Xuejian and Andy Lau both appeared.

Jason Wu, the leading actor, said many times that whether the role of Liu Peiqiang can be revived depends entirely on the meaning of director Frant Gwo.

Director Frant Gwo has also responded to how many more films The Wandering Earth will shoot. "Generally, one film is shot every four years, so as long as it is still moving, try to shoot it down.".

Sauce Garden Lane

Director: Chen Kexin

Starring: Zhang Ziyi

Release date: to be determined

In October, 2022, Chen Kexin announced the establishment of the pan-Asian production company "Changin’ Pictures" and entered the streaming media to explore a new model.

At that time, the most eye-catching project was the case of killing her husband in the sauce garden, but the original news was to shoot a drama series.

According to the national film script (synopsis) filed by the State Film Bureau in August, 2023, the filming of "Sauce Garden Lane" has been approved, and the writers are Shi Ling, Jiang Feng and Shang Yang.

In the recent Golden Rooster Promotion Conference, the film version of "Sauce Garden Lane" was impressively listed, directed by Chen Kexin and starring Zhang Ziyi.

Set in Shanghai in 1944, Jiang Yuan Lane focuses on the story of a woman who will kill her abusive husband. This case is known as one of the "Four Mysteries of the Republic of China".

Zhang Ziyi hasn’t produced a classic role comparable to The Grandmaster for a long time. I expect her to take a breath and shoot this tough new role.

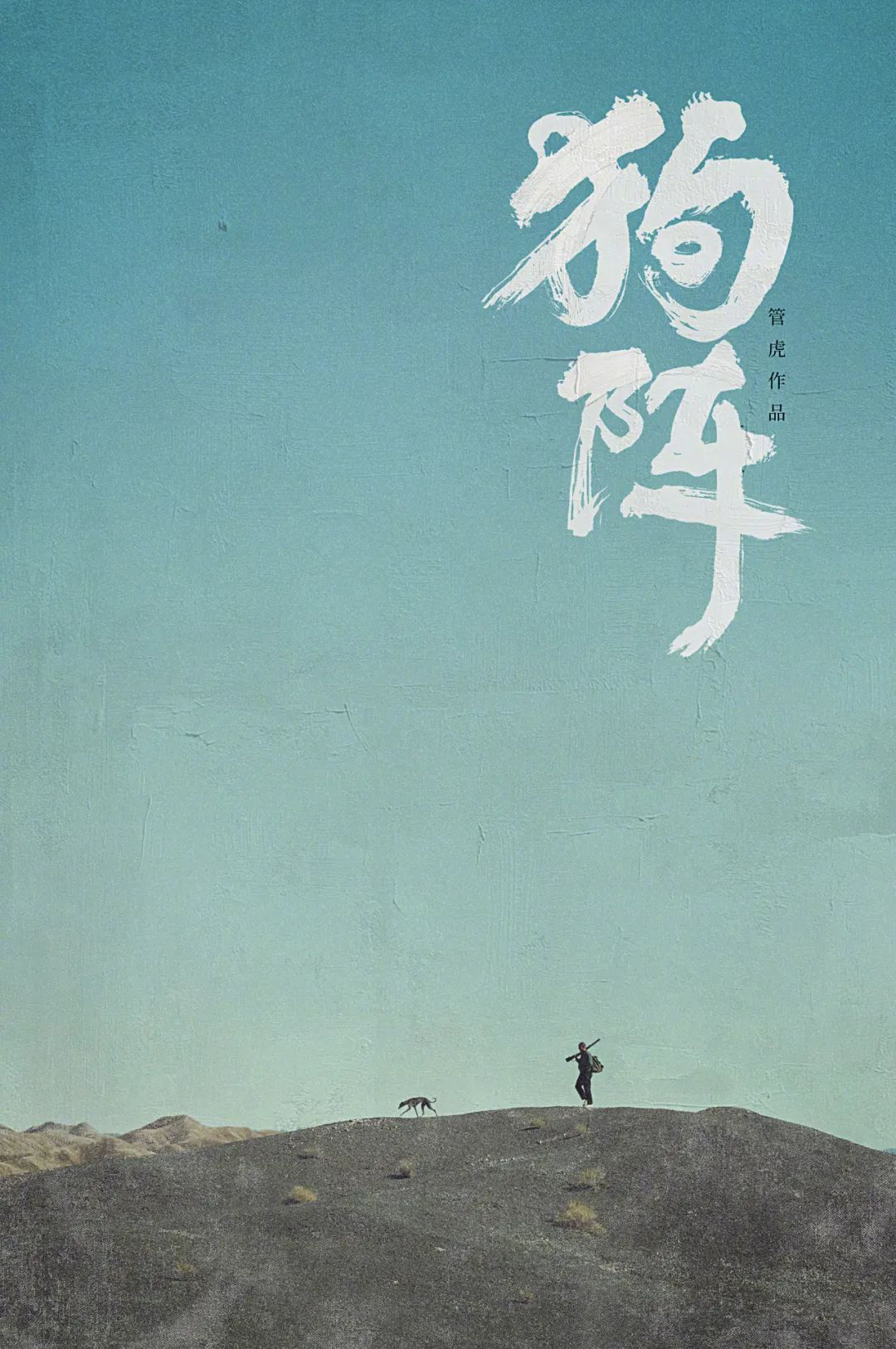

Dog array

Director: Guan Hu

Starring: Eddie Peng Yuyan/Tong Liya/Zhang Yi/Jia Zhangke

Release date: 2024

In 2020, The Eight Hundred, directed by Guan Hu, won the annual box office champion. Three years later, he brought a new film "Dog Array", which was directed independently.

The film tells the story of a man and a dog. Eddie Peng Yuyan plays the leading role, and Zhang Yi and Jia Zhangke are also seen in the list.

More than ten years ago, in the northwest town, Jiro (Eddie Peng Yuyan) joined the folk dog catcher for a living, and hauled stray dogs all day long. Until a stray dog came into his life and gradually developed feelings with him …

Jiro’s compassion for life was slowly awakened, and his deliberately suppressed blood and courage began to return. In order to save more stray dogs and redeem his soul, he took active actions.

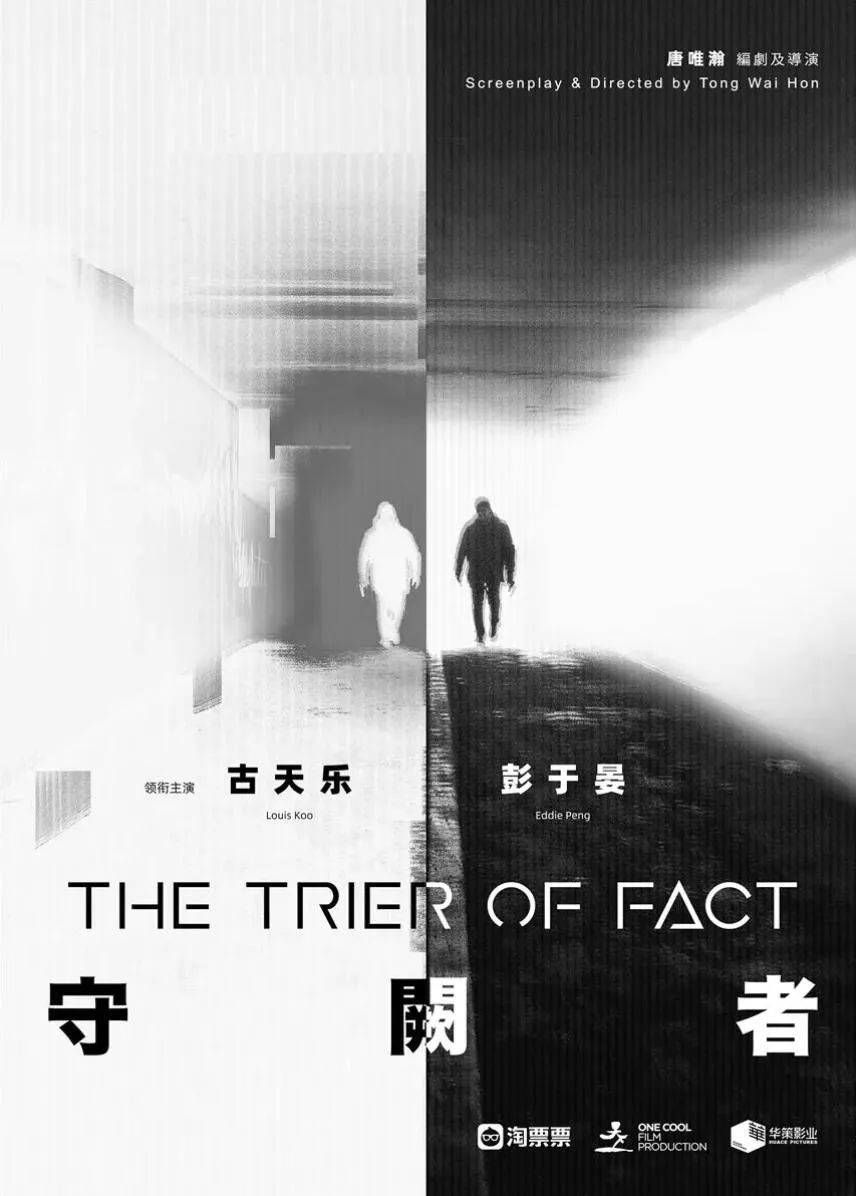

The queer keeper

Director: Tang Weihan

Starring: Louis Koo/Eddie Peng Yuyan/Jiang Haowen

Release date: 2024

The film was written and directed by Tang Weihan, an apprentice of the late Hong Kong director Chen Musheng. It seems to be a hard-core crime Hong Kong film with pure flavor.

Louis Koo and Eddie Peng Yuyan, who worked together in Wei Cheng directed by Chen Musheng nine years ago, are now continuing their friendship.

The film tells the story of Che Zhengguang, the inspector of the anti-drug group, and Xiao Shi, a young police officer who was ordered to undercover the anti-drug group, staged a "confrontation between good and evil" inside the police force.

Oriental wall street

Director: Qiu Litao

Starring: Andy Lau/Oho Ou/Crystal

Release date: 2024

In recent years, the directors of Andy Lau and Qiu Litao have been "deeply bound", from Shock Wave 2 series and Anti-drug series to Moscow Action in this year’s National Day file, and now to Oriental Wall Street.

But this time, they finally stopped making action movies, and director Qiu Litao made a rare film about finance, business and war.

As a model director who releases four films a year, can Qiu Litao bring new surprises to the audience?

Safe entry and exit

Director: Liu Jiangjiang

Starring: Shawn/Ayanga

Release date: 2024

"Going in and out safely" is the second cinema feature film directed by Liu Jiangjiang after "Life Events", which is based on real events and has been finished.

The film tells a story about the reversal of human nature.

Zheng Liguan (Shawn), a prisoner on death row who is about to be executed, was caught in an earthquake during his escort, and the detention center collapsed into ruins. Zheng Liguan seems to have gained sudden "freedom", but in fact he has fallen into another purgatory …

At the same time, police officer Wei Chixiao (Ayanga) decides to organize a rescue team temporarily. In the face of natural disasters, will death row inmates with only 24 hours to live escape or save lives?

Yang Enyou, a young actor who had an outstanding performance in the film "Life Events", cooperated with director Liu Jiangjiang for the second time. I wonder what kind of sparks they will collide with?

Decryption

Director: Chen Sicheng

Starring: Haoran Liu/Daniel Wu

Release date: to be determined

In the last two years, Chen Sicheng’s achievements as a producer are obvious to all. In the summer, his producer "Disappeared She" won 3.84 billion box office.

As a director, he also started his own new exploration of commercial genre films.

The new film Decryption, adapted from Mai Jia’s novel of the same name, is one of Mai Jia’s top suspense spy war IP trilogy.

The film story is set in the last century, when China’s nuclear program was strangled by American hegemony, and the mathematical genius Rong Jinzhen was involved in a thrilling Sino-US password war.

Decryption, starring Haoran Liu, looks like a talented character similar to Qin Feng in detective chinatown. Daniel Wu will also take part in this film, but the exact role has not been announced.

Plan p

Director: Zhang Luan

Starring: Jackie Chan/Wei Xiang

Release date: to be determined

Jackie Chan has returned to his best action comedy, this time with his new partner Wei Xiang.

Plan P tells the story of Jackie (Jackie Chan), an international action superstar, David (Wei Xiang), an agent, and Su Xiaozhu (Pan Zan Ya), a female fan who is keen on public welfare. By mistake, they are involved in a big conspiracy of international criminal organizations against the protagonist "P" and embark on a transnational adventure.

There is also a mysterious protagonist code-named "P" in the film, which is played by a famous China star, but it has not been announced yet. It seems that the film will keep the audience’s appetite alive.

Wind and water

Director: Chung Chi Li

Release date: to be determined

"Wind and Water" is the first independent film directed by Chung Chi Li, a senior action director in China and Hongkong. As a producer, Jason Wu helped the platform of old friends.

Chung Chi Li, a director who was born in a family class, was familiar to fans as an action director, such as New never to lose, Baby Plan, True Man, Kill the Wolf 2 and so on.

Jong Li Zhi and Jason Wu have known each other for many years, and once co-directed the action film Spike, which was also the directorial debut of Jason Wu. In the words of Jason Wu today, they "witnessed each other’s growth".

Heavy rain

Director: No thinking.

Release date: January 12, 2024

In 2017, the film "Dark cult Animated Film" and "The Great Protector" was born. The film is not only amazing in the form of violence, but also in the depth of the story content, as well as the excavation of human nature and the exploration of reality.

The new film "Heavy Rain" is a work that the director has returned to China six years after "The Great Protector". The whole film is hand-painted in two dimensions, which really brings China landscape painting to the big screen.

The plot expression of "Heavy Rain" is still sharp, and the color of "Diablo" is not diminished: the ancient ship sank many years later, and the boy’s steamed bread accidentally broke in, only to find that only the monster was left on board; When it rains in the night, the answer that everyone is looking for will surface. ……

Tianma Meteor

Director: Li Xiaofeng

Starring: Alan Aruna/Victor Ma

Release date: to be determined

The youth inspirational film with boxing theme was produced by Xú Zhēng and directed by Li Xiaofeng, director of Girl Nezha.

Alan Aruna, the leading actor, once made his mark in the film "The Water of the Donkey", and recently appeared in many new films, such as Antique close encounter of mahjong, The Knockout, Jedi Pursuit and Operation Moscow.

The film tells the story of two teenagers with completely different life paths who become friends in boxing trials, only to find that this accidental meeting is a designed "body double scam".

When dreams collide with reality, when friends who live together day and night become opponents who must be defeated, the two teenagers finally decide to pierce the illusion of life with boxing and fight for the common ideal.

Breakup list

Director: Yu-sheng Tian/Xia Yu

Release date: to be determined

The fourth film in the series "The Former" was filmed, but the fate between director Yu-sheng Tian and "The Former" continued.

The new film "Breakup List" is based on Song Xiaojun’s novel of the same name. Chengdu girl mustard and boy pepper become friends because of eating hot pot, and then become lovers.

Three years later, they didn’t walk into the marriage hall. Instead, they had to carry out the breakup list and complete a series of strange lists under the witness of their friends, which also restored their love and killing process.

Yu-sheng Tian, the director, revealed that he would put the ten years’ experience of "The Ex" series into the drama "The Breakup List" to create a new romantic film: "The ex series is almost over, but the romantic film still needs to be filmed, but few directors are willing to touch the romantic film, so we assume this responsibility.

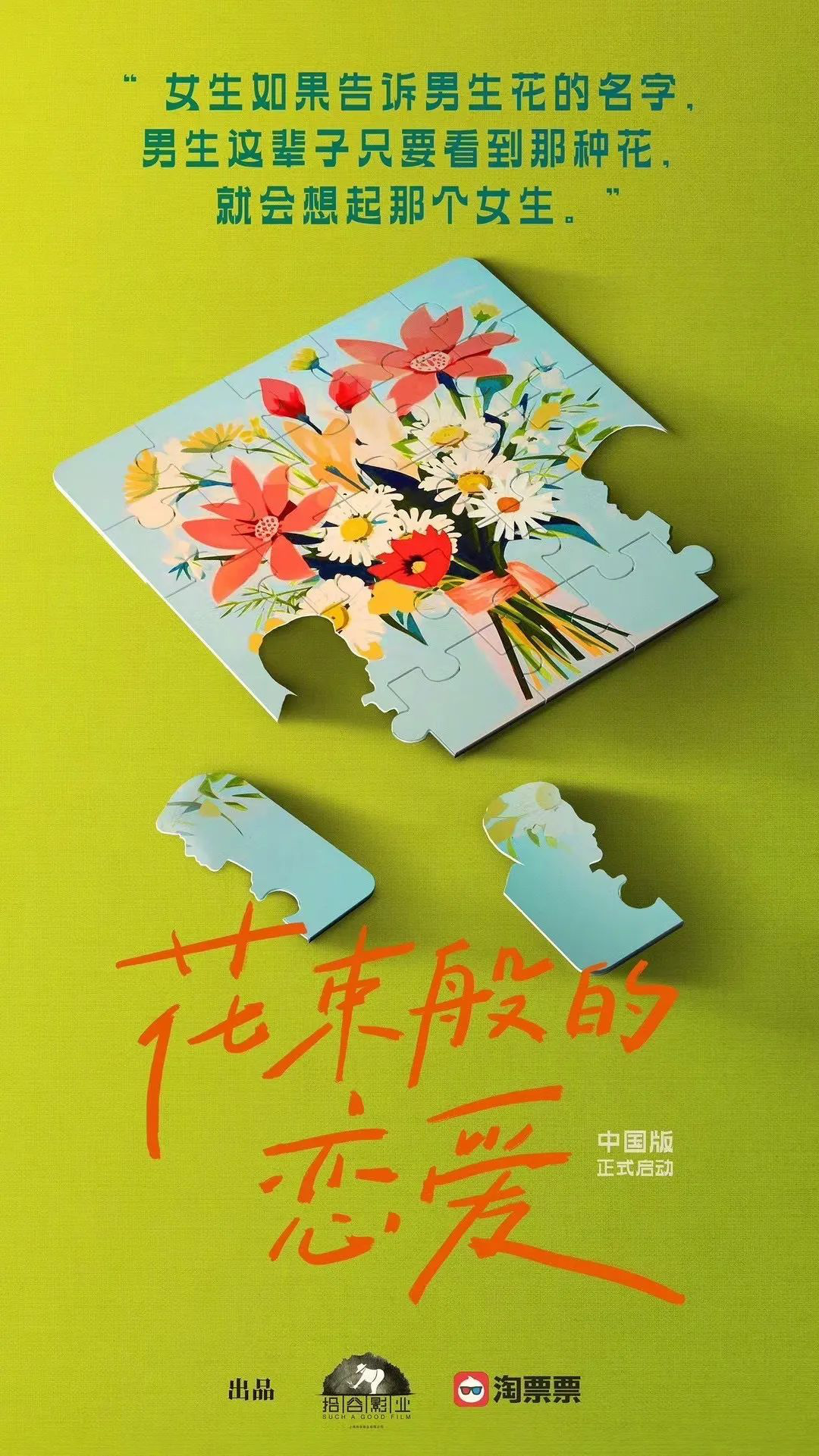

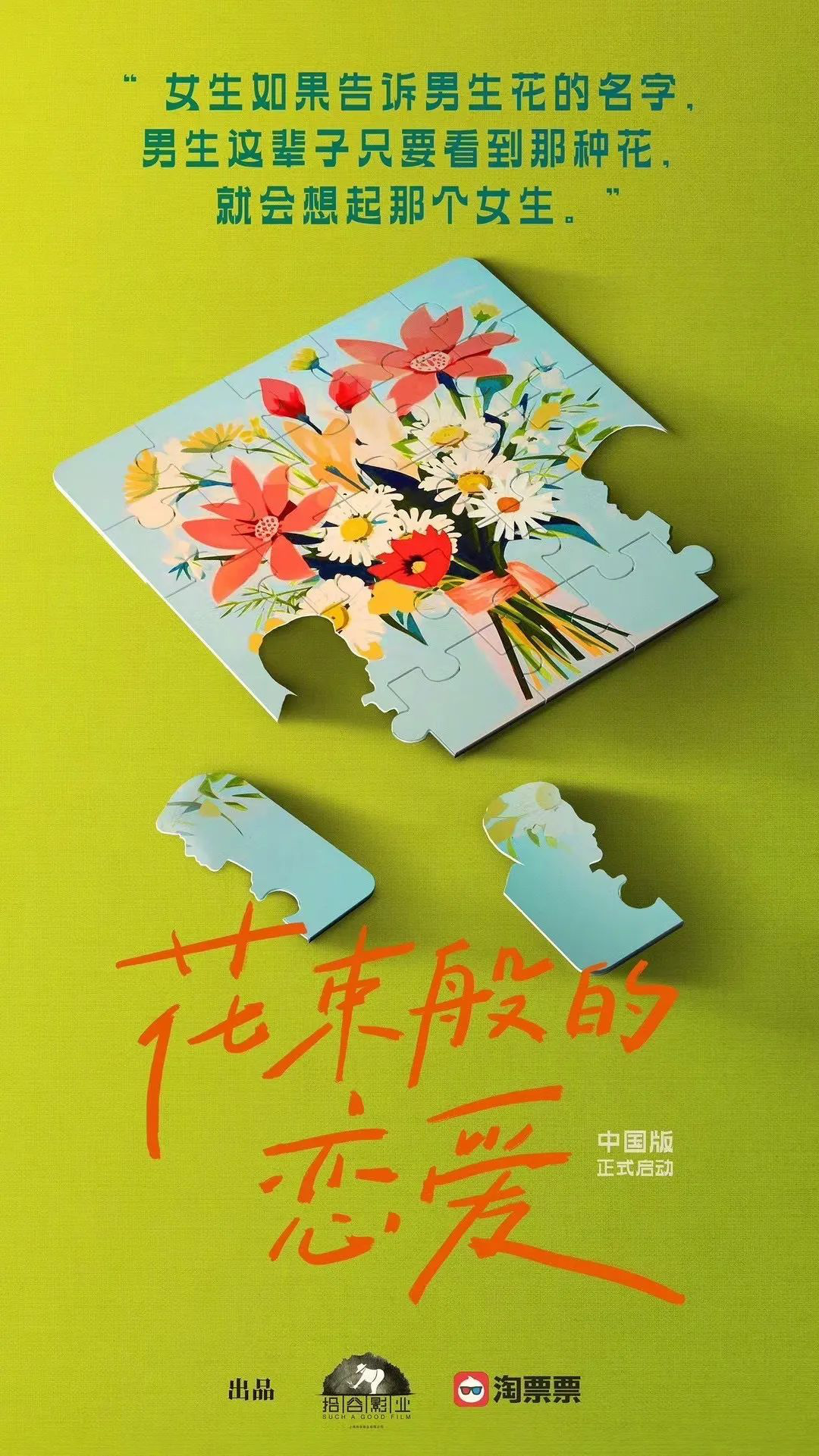

Bouquet-like Love (China Edition)

Producer: Shibuya Film, Alibaba Pictures.

Release date: to be determined

In 2021, the Japanese film "Love Like a Bouquet", starring Suda Masaki and Arimura Kasumi, won the love of many fans. The film was released in China in 2022.

It is reported that this film will be made into a China version, which will be produced by Zhang Yibai’s Shibuya Film Company and Alibaba Pictures. The film side announced that it took a year of hard work to win the copyright of the remake from the original director Yuzi Sakamoto.

Once this news was announced, it instantly ignited the adaptation desire of netizens all over the country.

The literary youth are always similar, and everyone has opened their minds and contributed the synopsis of the Beijing version, Shanghai version, Hangzhou version, Chengdu version and Chongqing version.

However, this film, which has a fresh Japanese literary style, will be adapted into what kind, or people can’t help but sweat.

Fire thief

Director: Xu Zhanxiong

Starring: Roy/Sophie/Liang Jingkang

Release date: to be determined

The theme of the Republic of China and the type of spy war focus on the growth and pursuit of teenagers in the great historical changes, spanning life and death and dark war. This is a spy war type film with the main theme.

The Fire Thief focuses on the growth and transformation of revolutionary pioneers in their youth.

The ages of the actors starring Roy and Sophie are consistent with the character setting, but whether they can perform the complex scenes of love for their country and farewell to life and death is still a big challenge.

Director Xu Zhanxiong once directed The Pioneer, and producer Huang Jianxin once escorted many main theme films. I believe that such a creative lineup will present a different texture from spy films.

Out of control family

Director: Lin Zhenzhao

Starring: Bao Beier/Wang Zhi/Cai Ming

Release date: to be determined

"Out of Control Family" is a comedy full of light humor and adventure, which is quite a bit like "Sorry" in those days.

The film revolves around Li Tongfeng (Bao Beier), a middle-aged entrepreneur. Li Tongfeng planned to go to Thailand alone to talk about the new electric vehicle agency business, but by mistake, his wife Jiang Yuanyuan (Wang Zhi) and her family joined the trip by force.

A foreign country, high-speed Mercedes-Benz, a family where chickens fly and dogs jump, brings a sudden crisis of life and death.