Phoenix Network Technology News January 25, Beijing time,Tesla has released a new quarterly financial report, and the situation is not very optimistic.Elon Musk reassured the market that he saw the company’s next "significant growth wave" coming, which was created by the new low-priced models that Tesla will start producing later next year.

However, investors are reluctant to wait until then. Now, Tesla shareholders are more concerned that Tesla’s last wave of major growth is fading. In 2023, Tesla cut prices throughout the year to boost sales, which eroded the company’s profits.Tesla warned that the price reduction promotion strategy has played a role, but it will not be so effective in 2024.

The sales prospects are bleak, and Tesla’s next-generation car is likely to be on the market for more than a year. Tesla investors are hard to be moved by Musk’s optimism. After the financial report was released, Tesla’s share price fell by 5.93% in after-hours trading, and its market value evaporated by 39.2 billion US dollars (about 278.7 billion yuan). Since 2024, Tesla’s share price has fallen by 16%.

High growth into the past tense

Seth Goldstein, an analyst at Morningstar Research, said in an interview: "Tesla’s signal to the market is that in 2024, the days when sales will increase by 50% or even 30% to 40% year-on-year will be gone forever. After all, if the price is reduced to a certain extent, you can’t reduce the price any more. "

Tesla also rarely provides annual delivery targets. For a long time, the company has set its average annual growth rate for many years at 50%. In 2023, after delivering about 1.8 million cars, Tesla almost reached this goal. Analysts predict that Tesla’s car sales will increase by about 20% in 2024, reaching 2.2 million units, which is about half the growth rate in 2023.

Tesla’s financial report also failed to meet market expectations.Tesla’s revenue in the fourth quarter of last year was $25.2 billion, lower than analysts’ expectations of $25.9 billion; Diluted earnings per share was $0.71, which was also less than analysts’ expectation of $0.73.

Musk "painting cakes"

Musk said that this year’s difficulties will be temporary, and he began to forecast Tesla’s new generation of low-cost cars.The model will be produced in Austin, Texas, the United States as early as the second half of next year, and then in Mexico, and will be produced at another site in North America in the future. This may help Tesla attract more mass market buyers, who may not be able to afford Tesla’s existing models starting at about $45,000.

"The next generation car will encounter a challenging capacity climb," Musk said. "Once it is started, it will far exceed the manufacturing technology existing anywhere else in the world, and the level will be one level higher."

However, before that, Tesla will continue to attract new consumers with its existing product line, and its latest model, Cybertruck, is gradually being mass-produced. Since the delivery in November last year, the production speed of Cybertruck is still slow. Tesla said that Cybertruck’s capacity climbing will be slower than other models. Musk did not give Cybertruck’s annual sales target.

For Tesla, the new product is particularly important because its model lineup is quite limited, which already includes the best-selling Model Y and Model 3.Although the sales of these popular models have soared every year since their launch, their prices are still relatively high. Last year, Tesla slashed the prices of these cars because high interest rates and inflation hit the household budget.

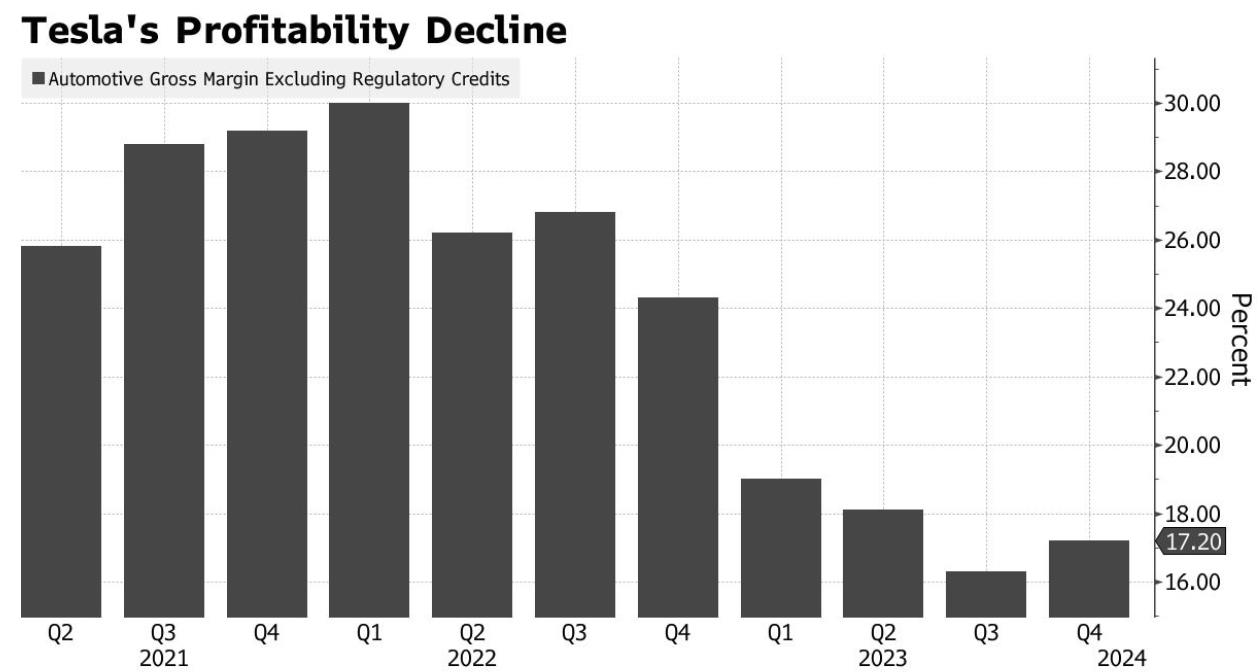

howeverThe price cut has damaged Tesla’s profits.Excluding carbon emissions revenue, Tesla’s gross profit margin of auto business in the fourth quarter was 17.2%, far below the level of the past few years. However, this is a slight improvement from 16.3% in the previous quarter. Tesla’s gross profit margin of auto business in the last quarter hit the lowest level in more than four years. Tesla attributed the decline in profit in the fourth quarter to other costs such as price reduction, increased R&D expenditure and Cybertruck’s capacity climbing.

In addition, Musk also asked for a 25% stake in Tesla, thus increasing his influence in Tesla.Musk said, "I just want to be an effective manager of powerful technology." However, Tesla’s board of directors is unlikely to grant Musk a new compensation plan unless a Delaware judge decides on the shareholder lawsuit triggered by Musk’s compensation plan in 2018. (Author/Xiao Yu)

For more first-hand news, welcome to download the Phoenix News client and subscribe to Phoenix Net Technology. If you want to see the in-depth report, please search for "Phoenix Net Technology" on WeChat.