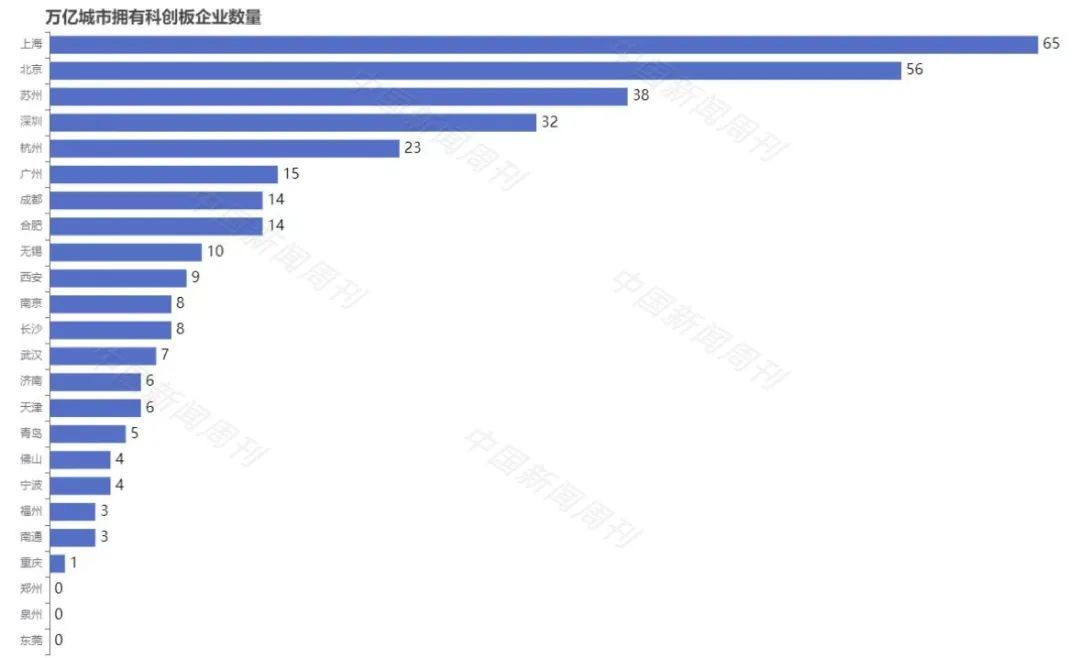

What is the "science and technology" color of 24 trillion GDP cities? The data of science and technology innovation board in the past three years gives the answer.

On June 13th, 2022, science and technology innovation board celebrated its third anniversary. According to official website of Shanghai Stock Exchange, there are currently 428 listed companies in science and technology innovation board with a total market value of 5.11 trillion yuan.

Among the 428 listed companies in science and technology innovation board, 175 companies’ operating income increased by more than 40% in 2021. There are 149 companies whose net profit returned to their mothers in 2021 increased by over 40% year-on-year. Such achievements far exceed the A-share main board.

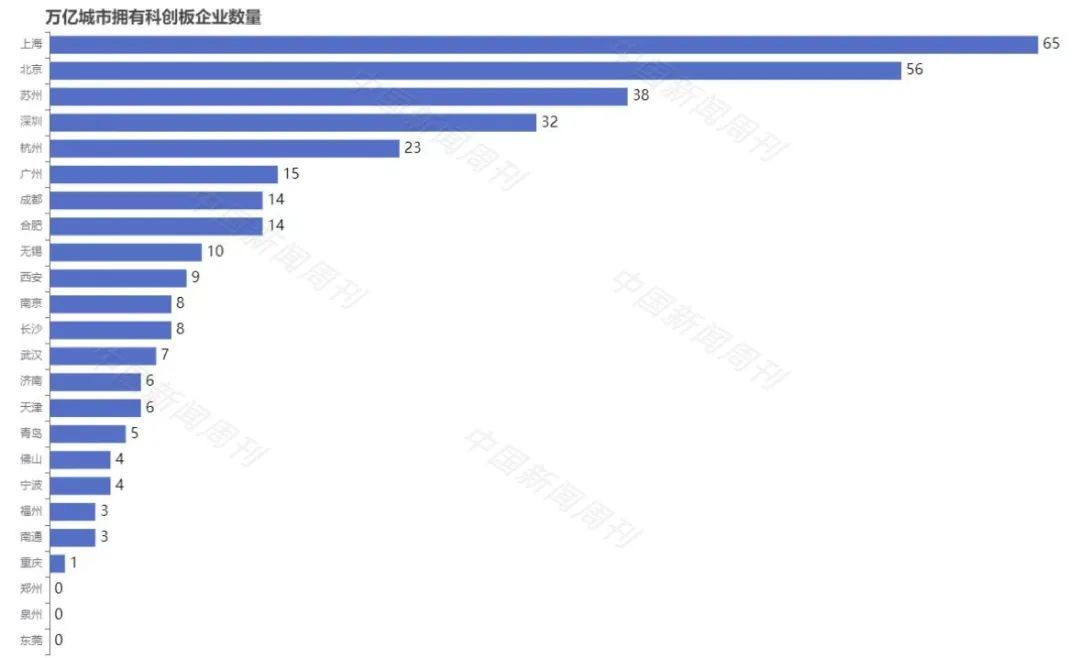

In terms of cities, Shanghai, Beijing and Suzhou have the number of listed companies in science and technology innovation board, ranking the top three among all cities. These three places have also become a highland that brings together the national science and technology strength. Hangzhou, Guangzhou, Chengdu, Hefei and Xi ‘an are among the top five provincial capitals.

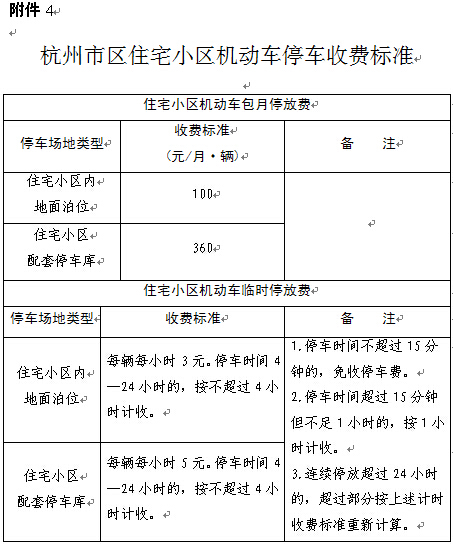

Data source: Local statistical offices.

Among the 24 cities with trillion GDP, science and technology innovation board enterprises in Chongqing have just achieved a "zero breakthrough" recently, and there are no science and technology innovation board listed companies in Zhengzhou, Quanzhou and Dongguan.

Companies that can be listed in science and technology innovation board are almost all hard-core technology companies. For example, science and technology innovation board’s listing requirements stipulate that the company’s accumulated R&D investment in the last three years accounts for no less than 15% of its operating income. Many industry analysts believe that science and technology innovation board has truly gathered the most scientific and technological enterprises in China, which is an important force to achieve industrial upgrading in various places and even the whole country.

"Hanging Zero" and Zero Breakthrough

On June 6th, Chongqing welcomed the first science and technology innovation board listed company — — Chongqing Shanwaishan Blood Purification Technology Co., Ltd. (hereinafter referred to as Shanwaishan).

It is understood that Shanwaishan is a company specializing in the production and sales of blood purification equipment and consumables. In the past 20 years, Shanwaishan has gradually broken the monopoly of imported blood purification equipment in China and greatly reduced the cost of dialysis treatment for uremia patients. But the road to science and technology innovation board is not smooth.

In August 2016, Shanwaishan was listed on the New Third Board, and was later selected into the list of key training enterprises to be listed in Chongqing in 2017. In October 2018, Shanwaishan delisted from the New Third Board and turned to science and technology innovation board for listing. In November, 2021, the Shanghai Stock Exchange accepted the declaration of science and technology innovation board.

In any case, Chongqing, which ranks fifth in the national cities in terms of GDP, has finally welcomed the first listed company in science and technology innovation board, while Chengdu, a neighbor of Chongqing, has 14 listed companies in science and technology innovation board.

"Compared with Chengdu, Chongqing, as a municipality directly under the Central Government, has a small hinterland and cannot mobilize the strength of a province. In addition, Chongqing’s industrial structure is traditional." Fu Lichun, an economist and founding partner of Yuntai Capital, said.

However, Chongqing, which noticed the problem, began to accelerate its layout. In February 2021, Chongqing issued the "Implementation Opinions on Further Improving the Quality of Listed Companies" and issued 16 policies to cultivate reserve resources and support enterprises to go public.

After several rounds of policies, the reserve forces have indeed improved. According to the Information Publicity Form of Enterprise Counseling Filing in Chongqing Area disclosed by Chongqing Securities Regulatory Bureau in 2021, there are about 30 enterprises "in the counseling period" or "counseling acceptance has been completed".

Compared with Chongqing’s zero breakthrough, Zhengzhou, Quanzhou and Dongguan have no listed companies in science and technology innovation board among the cities with trillion GDP. Among these three cities, Zhengzhou, the provincial capital, attracts special attention.

In 2021, Zhengzhou’s GDP was about 1.26 trillion, and its resident population reached 12.74 million, while the listed companies in science and technology innovation board remained "zero".

Zhengzhou is not in a hurry or indifferent. In December, 2021, the relevant policies issued by Zhengzhou specifically mentioned that enterprises within its jurisdiction will be rewarded with 10 million yuan if they can be listed in science and technology innovation board.

Now it has been half a year since the award was issued, and the number of listed companies in Zhengzhou and science and technology innovation board is still zero.

"Significantly different from companies listed on the main board, science and technology innovation board companies rely more on local scientific and educational resources, and places with rich resources in higher education and research institutes are undoubtedly more advantageous." Fu Lichun told China Newsweek.

Xi ‘an, which is the capital city of the north with Zhengzhou, has a slightly lower GDP in 2021. But at present, Xi ‘an has nine listed companies in science and technology innovation board, many of which rely on local high-quality scientific and educational resources.

For example, on March 7th this year, Shaanxi Huaqin Technology Industry Co., Ltd. was officially listed in science and technology innovation board, becoming the second achievement transformation enterprise of Northwestern Polytechnical University to land in science and technology innovation board.

Compared with Xi ‘an, which has many double first-class colleges and universities, Zhengzhou is obviously slightly inferior.

Industrial structure has become another major factor affecting the number of companies in science and technology innovation board.

In 2021, Quanzhou’s GDP was 1.13 trillion yuan, up 8.1% year-on-year, but the three leading industries were textile, shoes and clothing, petrochemical industry, building materials and home furnishing, and the economic focus was more concentrated in the county. Take Jinjiang, the "boss" of Quanzhou economy as an example, many famous brands such as Anta and Xtep have been born, but its industrial structure is far from the rigid condition that "R&D accounts for 15% of revenue" required by science and technology innovation board.

At present, 428 science and technology innovation board companies belong to 24 industries, among which the top three industries are computer communication and other electronic equipment manufacturing, special equipment manufacturing, software and information technology services, including 85, 78 and 62 companies respectively. This means that more than half of the listed companies in science and technology innovation board have been born in these three industries.

Cities with these three industries often become winners.

Invisible dark horse

Among all the cities with listed companies in science and technology innovation board, Shanghai and Beijing have 65 and 56 listed companies in science and technology innovation board respectively, making them the top two in the list.

However, the city with the third largest number of companies in science and technology innovation board is not the first-tier cities such as Shenzhen and Guangzhou, nor some strong provincial cities or sub-provincial cities, but Suzhou, which is known as the "strongest prefecture-level city".

Suzhou industrial park map/map worm creativity

At present, Suzhou ranks third in the national cities with the achievements of 38 listed companies in science and technology innovation board.

Science and technology innovation board Company in Suzhou has a very distinctive feature.

On June 13th, the company that Suzhou met recently — — Science and technology innovation board IPO of Suzhou Kaiweite Semiconductor Co., Ltd. (hereinafter referred to as Kaiweite) was accepted.

According to the data, Kaiweite was established in 2015, focusing on the design, research and development and sales of intelligent power semiconductor devices and power integrated chips. It is a national high-tech enterprise, a "technology giant enterprise" in Jiangsu Province and a "potential unicorn enterprise in Jiangsu Province".

Kaiweite is growing very fast. Relevant reports show that Kaiweite achieved a total operating income of 210 million yuan in 2021, an increase of 59.29% compared with 132 million yuan in 2020; The net profit was 43,561,700 yuan, which turned losses into profits.

Some analysts have pointed out that the emergence of many science and technology innovation board listed companies in Suzhou is closely related to the semiconductor industry it focuses on cultivating.

In the first quarter of this year, three of the four newly listed companies in Suzhou — — Guoxin Technology, Dongwei Semiconductor and Chuangyao Technology all come from the semiconductor industry.

As early as the beginning of this century, Suzhou showed its attention to the semiconductor industry. Over the years, Suzhou has continuously promoted the development of the industry through policies and gathered industrial resources.

At present, Suzhou has also formed a relatively complete semiconductor industry chain, such as Siruipu, a design company with a market value of 40 billion yuan. In addition, Huatian Technology and Tongfu Microelectronics, the three giants in domestic packaging and testing, all have important production bases in Suzhou.

In March 2021, Suzhou also issued "Several Measures to Promote the High-quality Development of Integrated Circuit Industry in Suzhou", proposing to give support according to the R&D investment of enterprises, focusing on supporting the third-generation semiconductors and other fields, and encouraging the transformation of enterprise achievements.

Hefei is another dark horse among the cities with trillion GDP.

In 2021, Hefei’s GDP reached 1.14 trillion, ranking 19th among all cities in China, while the number of listed companies in science and technology innovation board was 14, ranking 7th among cities in China.

On June 6th, Jingsong Intelligent, the latest listed company in Hefei, just landed in science and technology innovation board successfully. Eight days later, Hefei Jinghe Integrated Circuit Co., Ltd., which is engaged in 12-inch wafer foundry business, was registered by the Securities and Futures Commission in science and technology innovation board.

Not only that, Hefei also has 5 enterprises waiting for the meeting, 10 enterprises waiting for listing, and 30 enterprises for counseling and filing. The reserve force for listing is relatively substantial.

"Hefei has invested a lot in supporting scientific and technological innovation, especially in emerging industries such as chips, semiconductors and new energy, and the results achieved so far are also good." Yang Delong, chief economist of Qianhai Open Source Fund, told China Newsweek.

Recently, the Action Plan for Multiplying and Cultivating Specialized and Innovative Small and Medium-sized Enterprises in Hefei City was promulgated, proposing that by 2025, 1,500 specialized and innovative small and medium-sized enterprises in Hefei, 900 specialized and innovative small and medium-sized enterprises in the province and 20 individual champions in manufacturing industry should be cultivated, and 50 specialized and innovative small and medium-sized enterprises should be promoted to be listed.

The future competition will be more intense.

Under the pattern of urban competition, industrial upgrading has become the internal demand of each trillion GDP city to achieve high-quality development, and cultivating science and technology enterprises has become the key to this competition.

How should cities give full play to their endowments in this round of competition?

Dennis Huang, co-founder of Xiezong Strategy Management Group, told China Newsweek that the number of science and technology innovation board in different cities also reflects the capital activity of a city.

"science and technology innovation board focuses on high-tech and emerging industries, but such a format often requires large capital investment in the early days, and may even lose money. Investment in emerging industries tests local supporting measures in many aspects. " Dennis Huang said.

In terms of cultivating science and technology enterprises, the "Hefei model" is a smash hit. Through the investment in BOE, Changxin Storage and Weilai, Hefei has shaken the display industry, semiconductor industry and new energy automobile industry. Hefei’s GDP ranking has also increased from nearly 80 in the country 20 years ago to 19, and its fiscal revenue has increased dozens of times. More importantly, Hefei’s industrial structure has also been transformed and upgraded.

With the success of "Hefei Model", major cities have followed suit.

Since 2022, many people in the investment community have clearly felt that the industrial funds set up by local governments this year are accelerating.

Recently, Changsha High-tech Zone launched 20 billion angel mother funds and seed funds to support scientific and technological innovation; Xi’ an set up an innovation investment fund with an initial scale of 10 billion yuan; Chengdu and Chongqing also jointly set up the Twin Cities Fund; Guangzhou even announced the establishment of 150 billion industrial parent funds and 50 billion venture capital parent funds … … From south to north, from east to west, many cities have entered the game.

"Now attracting investment, excluding the unique resources of first-tier cities, the Yangtze River Delta and the Pearl River Delta have good market reputation and industrial chain supporting advantages. Unless Hainan Island is an island-wide free trade zone and has incomparable policy advantages in other regions, other cities are more and more dependent on the overall supporting services when introducing advantageous projects. At this time, the role of industrial funds is highlighted." Zhang Lixiang, assistant to the president of Guangzhou Nanyue Fund Group, told China Newsweek about his observation on the industry.

How much investment the local government can give has become a key factor for many science and technology enterprises to choose to settle down.

"Incubating science and technology enterprises needs industrial foundation, scientific and technological foundation, university foundation, and an overall entrepreneurial atmosphere. Under this premise, local governments can act positively, actively introduce early science and technology enterprises, guide funds to actively support them, and provide a package of services in listing counseling, which may be the key to future science and technology incubation. " Fu Lichun said.