"Harbor Business Watch" Wang Xinyi

Left-handed car, right-handed mobile phone, and a rocket on the back. Geely Group’s current business can be described as getting busier and busier.

Looking closely at the automotive sector, the latest monthly car sales have declined year-on-year. On the new energy vehicle track, how can veteran Geely widen the gap with new forces?

01

Acquiring Meizu, Geely’s Rocket Dream "Ambition"

Zhejiang Geely Holding Group Co., Ltd. (hereinafter referred to as Geely Group or Geely Automobile, 00175.HK) was founded in 1986. It started from the production of refrigerator parts and developed to the production of refrigerators, freezers, building and decoration materials and motorcycles. Until 1997, Geely Group officially entered the automotive industry. Five years later, in 2002, Geely Automobile had reached the top ten achievements of Chinese automobile enterprises.

According to public information, Geely Group currently owns Volvo Cars, Geely Automobile, Lynk & Co Automobile, Polestar, Proton Automobile, Lotus Automobile, London Electric Vehicle, Long-range New Energy Commercial Vehicle and other automobile brands. But unlike other private auto companies, Geely Group’s "ambitions" do not stop at automobiles.

On the afternoon of June 13, 2022, the State Administration for Market Regulation announced the case of Hubei Xingji Times Technology Co., Ltd. acquiring the equity of Zhuhai Meizu Technology Co., Ltd. According to the public information, Xingji Times has signed an agreement with Meizu Technology and the shareholders involved in the transaction, and Xingji Times intends to acquire 79.09% of the equity of Zhuhai Meizu and become the actual controlling person.

Hubei Xingji Times Technology Co., Ltd. is a mobile phone company under Geely. It was established in September 2021. According to relevant public information, Geely Mobile has established four new companies in May this year. But currently choosing to enter the mobile phone industry does not seem to be the best option.

The Prospective Industry Research Institute’s "China Mobile Phone Industry Market Prospect and Investment Forecast Analysis Report" shows that from 2018 to 2021, the proportion of domestic brand mobile phone shipments in total mobile phone shipments showed a downward trend, and the proportion of domestic mobile phone shipments in 2021 was 86.6%, the lowest point in the past four years.

The reason why Geely chose mobile phones, Li Shufu, chairperson of Geely Group, explained: "Mobile phones can connect vehicles to everything, satellite Internet, create rich consumption scenarios, and strengthen the ecosystem, which is conducive to building a user ecological chain, building a corporate moat, and better coordination with the automotive business."

If mobile phones are about better synergy with the car business, then Geely’s dream of "going to heaven" seems to be explained by this.

On April 17, 2020, Yang Xueliang, vice president of Geely Automobile Group, posted on Weibo: "Recruitment of rocket chief engineer, welcome to sign up, resume @Geely Recruitment." On June 2, 2022, Geely Automobile launched a rocket carrying a total of nine satellites.

In order to build a better intelligence system, Geely Group’s "buy buy buy" has involved many fields. Some people think that if you do too much, you forget to start a car, and the car is not good.

"This statement is in line with the fact that companies need to focus on their main business and avoid the dispersion of resources." Bai Wenxi, chief China economist at IPG, told Harbor Business Watch:"Geely’s acquisition model, whether it is the acquisition of a number of car companies before or the recent acquisition of Meizu in the mobile phone sector, can only be sustainable and enhance and strengthen the industrial chain and ecosystem of the enterprise if it realizes the specialization of the operation while diversifying the investment.

02

Sales volume is under pressure, net profit and net asset return continue to decline

Looking at the main business of Geely Group, the latest sales data of Geely Automobile does not seem to be satisfactory. According to Geely Automobile’s monthly report,The cumulative sales volume in the first five months of 2022 was 487,000, down 8% year-on-year. Among them, the sales volume in May was 89,100, down 7% year-on-year.

The difference is that Geely Automobile has achieved new breakthroughs in the field of new energy vehicles in the sub-sector. In May 2022, Geely Automobile sold 19,619 new energy vehicles, an increase of 304% year-on-year, an increase of 39% month-on-month, and a penetration rate of 22%.

Not only Geely Automobile’s new energy brand, the entire new energy vehicle industry has achieved good results in May. According to the latest data released by the China Association of Automobile Manufacturers, China’s new energy vehicle sales in May were 447,000, an increase of 49.6% month-on-month and 105.2% year-on-year. The cumulative sales volume from January to May was 2.003 million, an increase of 111.2% year-on-year.

For new energy vehicles, the outside world has always held a high degree of popularity, and there is no shortage of optimism about new energy vehicles. Yu Fenghui, a famous economist and new finance expert, told Harbor Business Watch: "The replacement of fuel vehicles by new energy vehicles is definitely a direction. In the current situation where the oil price is about to exceed ten yuan per liter, it is an opportunity for new energy vehicles. Although the price of new energy vehicles is also rising, the price increase is a rigid cost and must be raised. If it does not rise, it will lose money. But new energy vehicles must be a development opportunity. It can be seen that although new energy vehicles are temporarily difficult, the pace of development of new energy vehicles deserves to be firmly optimistic."

For the capital markets, this year’s new car-making forces are on the rise. On March 10, 2022, NIO landed on the Hong Kong Stock Exchange, which is NIO’s second return to Hong Kong listing after the listing of US stocks. On March 17, Zero Run Auto submitted a prospectus to the Hong Kong Stock Exchange. On June 1, Weimar Motor also chose to submit to the Hong Kong Stock Exchange. In the face of the new energy vehicle cake that the market is competing for, how can Geely Automobile join the list?

According to public information, Geely Automobile has Geely New Energy, Lynk & Co, Geometry, Proton, Lotus, Volvo New Energy and Extreme Krypton in the new energy sector. This year, Geely will add two new energy vehicle brands. On June 17, Geely’s new new energy brand RADAR held a brand launch. On June 21, Geely Ruilan brand will also be officially released. The official description of the brand is that it focuses on the positioning of "changing electricity and light travel".

Compared with the "back waves" of new energy vehicles, Bai Wenxi believes: "Geely Automobile is growing faster than itself in the field of new energy vehicles, but compared with other new energy and new power car companies, both in terms of core technology innovation ability and marketing seem to be slightly inferior, but Geely’s enterprise scale, industrial supporting and manufacturing capabilities will be stronger."

Look at Geely Automobile as a whole in recent years. In 2021, Geely Automobile achieved operating income of 101.611 billion yuan, which is the second time after 2018 that its revenue exceeded 100 billion yuan. In 2019 and 2020, Geely Automobile’s revenue was 97.401 billion and 92.114 billion respectively, showing a downward trend. Correspondingly, Geely Automobile has continued to decline in net profit attributable to its parent in the past three years.From 2019 to 2021, 8.19 billion, 5.534 billion and 4.847 billion.

Bai Wenxi said: "The reason why the revenue will exceed 100 billion again, while the profit of the parent company continues to decline, on the one hand, it may be related to the decline in the average gross profit margin caused by industry competition, and on the other hand, it may also be caused by the increase in the proportion of sales of low-margin products in the product structure caused by the adjustment of the company’s market strategy."

At the same time,Geely Automobile’s average return on net assets in the past three years has shown a significant downward trend, reaching 16.48%, 9.37% and 7.33% respectively.

Some market voices believe that the company’s net profit has continued to decline, as has the average return on net assets, which may reflect to some extent that the company’s profitability is weakening. How does the company plan to boost it? Harbor Business Watch contacted Geely Group to inquire about relevant issues, but did not receive a corresponding reply.

In addition to the decline in performance, in the capital markets, Geely Automobile has not been able to escape the decline shared by automakers this year. "Harbor Business Watch" found that from December 17, 2021 to June 17, 2022, six months, Geely Automobile fell by 35.13%.

(Geely Automobile’s share price trend in the past half year, picture source: Flush (300033))

Yu Fenghui said: "The decline is relatively normal. In the new energy vehicle sector, it is affected by raw materials, and traditional cars cannot escape the epidemic. One of Geely Automobile’s R & D centers is located in Shanghai, and under the influence of the epidemic, Shanghai has been under control for a period of time, which has a great impact on car companies. Including NIO, XPeng Motors, and Li Auto, the three major new energy vehicle brands listed on Wall Street have all experienced sharp declines."

03

Quality "hidden danger", vehicle recall four times a year

Looking at the complaints against new energy vehicle companies this year, the failure to deliver cars is definitely an important issue. In the current market environment, the global price of lithium and nickel has risen sharply, and the cost of building cars has increased, so that many car companies have delayed delivery.

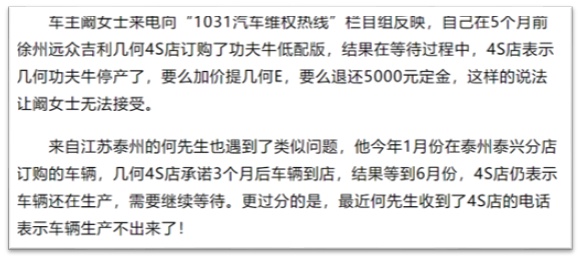

The difference is that most car companies complained about the delay in delivery, which aroused consumer dissatisfaction, while Geely Automobile may have directly chosen to stop production and hoped that consumers would return the car. On the Black Cat complaint platform, there are consumer complaints: "I ordered a Geely Kung Fu Niu ordinary new energy passenger car in early February, and agreed to deliver the car in April. In June, the dealer told me that there was no car and asked me to return the car. However, since March, the price of new energy vehicles has increased by nearly 10,000 yuan, the waiting time and the cost of buying a car have increased significantly, and the manufacturer has forced the car to return, causing serious losses to consumers."

After searching by "Harbor Business Watch", it was found that there was not only one such complaint. Is the company’s production still greatly affected by macro factors? Is the company’s vehicle production normal? "Harbor Business Watch" contacted Geely Group and did not receive any response.

(Source: FM1031 Jinan Traffic Radio)

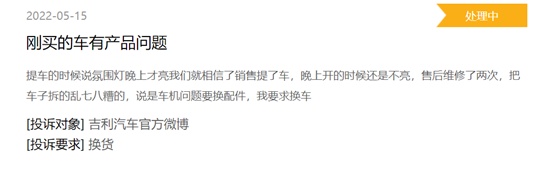

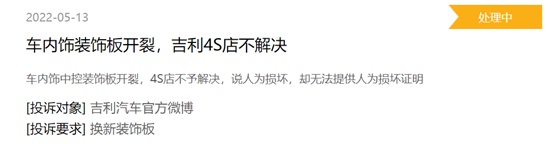

On the Black Cat complaint platform, Harbor Business Watch searched Geely Automobile and found that as of June 17, 2022, the company had 393 complaints on Black Cat complaints, 9 had been replied, 7 had been completed, and the completion rate was less than 2%. Including complaints about the quality of the transmission and engine.

"The gearbox was damaged after driving 29,000 kilometers, which caused the gear to change to neutral. The product had serious quality problems. It broke down during use. It caused road hazards. Serious quality problems threatened personal safety. The manufacturer refused to solve the quality problem on the grounds that the product was out of warranty."

"My car is about 48,000 kilometers long. During heavy rain, the windows automatically fell (twice in a row), causing water to accumulate in the car. The next day, the gearbox failure light came on, causing the engine to fail to start normally."

(Image source: Black Cat Complaint)

Quality problems do seem to be a long-standing "hidden danger". According to Qichacha, Zhejiang Haoqing Automotive Manufacturing Co., Ltd. (100% owned by Geely Group) has had four vehicle recalls due to quality problems in 2021. There have been 14 recalls since 2019.

The most recent recall of vehicles occurred on April 7, 2022. A total of 18,031 vehicles were recalled for some 2016 Geely Vision GC7 vehicles produced from January 27, 2016 to November 26, 2016. The reason is: During the driving of the vehicle under specific working conditions (long uphill and rapid acceleration), the transmission oil pot may leak oil, and the spilled oil may cause fire in the case of fire source, which poses a safety hazard.

Whether Geely Group’s "buy buy buy" model can really construct a more comprehensive system of self-occupied vehicles to everything is unknown, but the current product after-sales complaints have not been replied, and the product has been recalled frequently, which urgently needs to be rectified. (Produced by Harbor Finance)

This article was first published on WeChat official account: Harbor Business Watch. The content of the article is the author’s personal opinion and does not represent the position of Hexun.com. Investors operate accordingly, and please bear the risk.