CCTV News:Statistics show that the number of mobile payment users in China has exceeded 800 million, and the scale of mobile payment market ranks first in the world for three consecutive years. So, who liked mobile payment best in the past year? How many times will I use mobile payment every day? A survey report released by China UnionPay today (February 1st) reveals how popular mobile payment is.

Through the investigation and analysis of more than 170,000 people in China, China UnionPay released the "2020 Mobile Payment Security Survey Report" today. According to the report, 98% of the respondents chose mobile payment as the most commonly used payment method.

According to the survey, in 2020, the average person will use mobile payment three times a day, and the proportion of people who use it five times a day will also reach a quarter of the total number of people surveyed. Who likes mobile payment best? The answer is men born after 1995, who use mobile payment four times a day on average. In addition, QR code payment has become the most commonly used mobile payment method, with users accounting for more than 85%. So, where do people like to use mobile payment most?

Wang Yu, senior director of the risk control department of China UnionPay, said that online, credit card repayment, online shopping, virtual goods, take-out and other related scenarios are frequently used. Offline, it is mainly used by small and micro businesses. People over the age of 50 use mobile payment for offline shopping, mainly in vegetable markets, supermarkets and some physical retail stores.

Bad habits affect the security of mobile payment.

Mobile payment is becoming more and more popular in our life, so is it safe? According to the survey of China UnionPay, 98% of the respondents think that mobile payment is safe. However, further investigation also shows that people still have many unsafe habits when using mobile payment.

The survey shows that when using mobile payment, about 70% of users have had bad habits that affect payment security, with an average of 2.4 bad habits per user. Wang Yu said that there are three aspects that are relatively advanced. First, all payments use the same payment password. Second, pay in the public wi-fi environment during use. Third, when changing the mobile phone, the bank card binding in the APP was not released in time.

Wang Yu said that these three bad habits were repeatedly reminded by financial institutions and the media, but many people still paid insufficient attention to them. In addition, it is also a common bad habit to try to scan the code when you see the QR code of the promotion, and choose to remember the login password in the website or APP. These bad habits are also the important factors that lead to the risk of mobile payment. The survey also shows that in 2020, 8% of the respondents suffered from online fraud and incurred actual economic losses, among which, the post-00 age group suffered the highest proportion of losses, reaching 19%.

Participating in online gambling suffered the most.

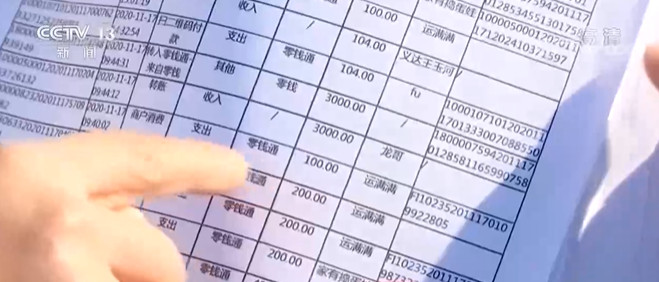

The survey report of China UnionPay also shows that the overall loss of people who suffered online fraud in 2020 decreased by 4 percentage points compared with 2019. However, new forms of fraud such as online gambling and running points need to be more vigilant. Among the respondents, nearly 60% of those who have participated in online gambling have suffered economic losses.

The survey shows that criminals’ precise fraud against different groups of people needs the public’s key prevention. In July last year, Ms. Gao from Wujiang, Jiangsu and others downloaded a mobile phone APP called "Animal World". By purchasing virtual animals in the software, players can download them in 1— Within 15 days, there will be 5% & mdash; 30% of the proceeds.

It was easy to make money, so Ms. Gao and others began to increase their chips. The animals snapped up changed from a white swan with a yield of 5% of 1,000 yuan to a loong with a yield of 30% that needed tens of thousands to buy. At the end of last year, the platform system suddenly collapsed and animals could not be sold. At this time, Ms. Gao and others realized that they had been cheated.

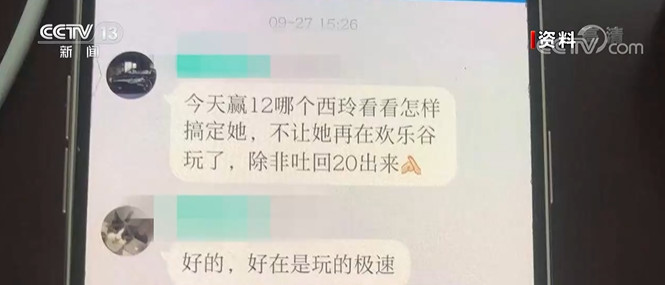

Not long ago, Guangdong and Shanghai police jointly cracked a case of fraud in the name of online gambling. Criminals set up a platform called "Happy Valley" on the Internet to lure others to gamble. Players can make money at first, but after a while, they will find that they can’t get the money out. After the police dug up this criminal gang, they found that their gambling platform was as high as 12 million yuan in just one month. In the investigation report, China UnionPay pointed out that many online gambling are essentially telecom fraud, and the so-called "steady profit without loss" and "insider" are all pre-edited words.

Expert advice: develop safety habits and keep personal information.

Sweep and touch to complete the payment, and the convenience of mobile payment makes it more and more popular. So, what risks do we need to guard against during use? China unionpay experts put forward preventive suggestions.

The first is to manage personal accounts and QR codes, cancel sleep bank cards and accounts in time, and do not lend or rent personal bank cards and payment codes. If the lending account is used for illegal fund transfer, the provider will be prosecuted and cannot use mobile payment for 5 years; Secondly, protect personal sensitive information, and do not casually fill in payment information such as card number, expiration date and password on the website; Prevent criminals from using gimmicks such as "high-interest financial management" and "virtual currency" to lure "interests" to commit fraud; Third, resolutely resist illegal platform activities such as online gambling and "running points", and don’t believe in so-called quick ways to make money such as "brushing the bill" and "part-time job".

In addition, when paying, you should also pay attention to not connecting to public wi-fi for payment, especially when replacing the mobile phone, you must pay attention to unbinding the APP from the bank card, uninstalling the APP, and restoring the mobile phone to the factory settings.

Wang Yu also reminded that once the mobile phone is lost, it is necessary to report the loss of the mobile phone card to the operator at the first time, report the loss of the bank card to the bank, and freeze account transactions. If there are payment software such as WeChat and Alipay in your mobile phone, you should also report the loss or freeze your account at the first time to avoid possible losses.