[Policy]

Standing Committee: Ensure reasonable economic growth in the second quarter and stabilize the economic market.

On June 8, Li Keqiang, Premier of the State Council of the People’s Republic of China presided over the the State Council executive meeting, stressing that the downward pressure on the economy is still outstanding. To effectively coordinate epidemic prevention and control and economic and social development, all localities should earnestly shoulder the responsibility of ensuring the well-being of one party’s livelihood, promote the refinement and implementation of economic stabilization policies with a sense of urgency, further release the policy effect, ensure reasonable economic growth in the second quarter, and stabilize the economic market.

Since June, all parts of the country have also introduced policies to stabilize the economy and support industries. For example, Shanghai Cultural Tourism Bureau and Bank of China (601988) Shanghai Branch jointly organized "Financial Benefits for Enterprises, Revitalization of Cultural Tourism". The cultural tourism industry in Shanghai resumed and revitalized the docking between banks and enterprises, and five banks jointly granted credit of 50 billion yuan to support the recovery and revitalization of the cultural tourism industry; Guangzhou issued a package of policies and measures to stabilize the economy, including six major policies such as stabilizing investment and promoting consumption, with a total of 152 practical measures; Chengdu issued "Several Policies and Measures to Enhance Development Resilience and Stabilize Economic Growth"; Wuhan issued the "Notice on Printing and Distributing Several Measures for Accelerating Consumption Recovery and Boosting in Wuhan" and so on.

The State Council issued the overall plan for deepening the all-round cooperation between Guangdong, Hong Kong and Macao in Nansha, Guangzhou.

On June 14th, the State Council announced the "Guangzhou Nansha Overall Plan for Deepening the All-round Cooperation between Guangdong, Hong Kong and Macao Facing the World", clearly supporting Nansha to become a major strategic platform based on the Bay Area, cooperating with Hong Kong and Macao and facing the world; Optimize the business environment, and accelerate the creation of a rule-linking mechanism to dock the highlands.

Beijing has issued policies to support the transformation and upgrading of commercial entities, with a maximum amount of 5 million yuan for a single project.

On June 20 th, the Beijing Municipal Bureau of Commerce formulated and issued the "Guidelines for the Application of Quality Improvement Projects in Traditional Shopping Mall and Commercial Circle (Characteristic Commercial Street)", which clearly supports the transformation and upgrading of commercial entities, and gives a one-time reward to the project. The proportion of financial support does not exceed 4.35% of the approved actual investment; The amount of support for a single project does not exceed 5 million yuan.

Support the digital construction of commercial entities in the business circle (characteristic commercial street), and give a one-time award to the project. The proportion of financial support shall not exceed 50% of the actual investment approved; The amount of support for a single project does not exceed 2 million yuan.

Shanghai issued the key issues of optimizing the business environment in 2022. Enterprises opening new stores can be exempted from on-site inspection.

The Key Issues of Optimizing the Business Environment in Shanghai in 2022 was officially issued. By the end of 2022, the city will complete 10 key issues of optimizing the business environment, such as convenient enterprise registration and caring business services. For example, the implementation of chain food business license facilitation and the opening of new stores by enterprises can be exempted from on-site inspection.

Guangzhou Huadu: An international duty-free tourism consumption center will be basically built in 2025.

The Action Plan for Cultivating and Building an International Consumer Center City in Huadu District proposes to give full play to the overlapping advantages of the core area of air-rail integration and the duty-free tuyere to build a duty-free business circle of Guangzhou North Railway Station. By 2025, four international core business districts, namely CBD in the main city, duty-free commercial complex in Guangzhou North Station, Rongchuang Wenlv City and Shiling Fashion Consumption, will be initially built, and an international duty-free tourism consumption center will be basically built.

Tianjin issued a policy to promote night economy: it is planned to promote it from eight aspects, including enriching business forms.

The Tianjin Municipal Bureau of Commerce issued the Notice on the Key Work of Cultivating and Building an International Consumer Center City in Tianjin in 2022 to Promote the Innovation and Development of Night Economy, which made it clear that the night economy in Tianjin will be promoted from eight aspects, and the business circle effect, diversified formats, immersive experience, business travel and online celebrity night market will be connected in series to enrich the business forms of night economy.

Wuhan has built 112 convenient living circles for a quarter of an hour, and 40 newly-built and renovated community business centers.

On June 6th, Wuhan issued the "Implementation Plan for the Construction of a National Pilot City for a Quarter-hour Convenience Living Circle in Wuhan", proposing that by 2025, 112 convenience living circles will be built and 40 new community commercial centers will be built in 37 pilot communities in 12 districts of the city, with a per capita commercial area of 0.8 square meters.

[data]

The national economy showed a recovery momentum in May and is expected to achieve reasonable growth in the second quarter.

On June 15th, according to the data of the National Bureau of Statistics, the total retail sales of social consumer goods in May was 3,354.7 billion yuan, down 6.7% year-on-year. According to consumption types, the retail sales of goods in May was 3,053.5 billion yuan, down 5.0% year-on-year; The catering revenue was 301.2 billion yuan, down by 21.1%.

On the same day, the State Council Press Office said at a press conference that the national economy showed a recovery momentum in May, the economic operation was expected to further improve in June, and the economy was expected to achieve reasonable growth in the second quarter.

Beijing’s core business district rent increased by 2.1% year-on-year in the second quarter, and the vacancy rate of retail market in Guangzhou and Shenzhen in the second half of the year may be under pressure.

According to the dtz report, in the second quarter, the vacancy rate of Beijing’s overall retail market decreased by 3.6 percentage points year-on-year to 13.9% without new supply; Although the re-outbreak of the epidemic has caused the overall market turnover to decline, the impact on the rental level of the whole city and the five core business districts is relatively limited, with a decrease of 0.6% month-on-month and an increase of 2.1% year-on-year to 332.7 yuan and 386.0 yuan per square meter per month.

In the first half of 2022, the vacancy rate of Guangzhou retail market rose to 5.7%, and the average rent level of the best floor of shopping centers in the city rose slightly to 776.1 yuan per square meter per month; The overall vacancy rate of Shenzhen quality shopping center also remained at 5.7%, and the average rent of the best floor rose slightly to 860.21 yuan per square meter. Considering that the impact of the epidemic on the market is lagging behind and the demand has not fully recovered after the epidemic, it is expected that both the market rent and vacancy rate in Guangzhou and Shenzhen will be under pressure in the second half of the year.

[Project]

In June, more than 10 shopping centers nationwide opened, and two Vientiane cities in Fuzhou and Haikou were unveiled.

According to incomplete statistics, in June, more than 10 shopping centers nationwide opened, covering Beijing, Hangzhou, Chongqing, Fuzhou, Fuyang and other cities, including two Vientiane Cities in Fuzhou and Haikou, wanda plaza in Jinhua Yongkang, Baolongcheng in Jiaojiang, Taizhou, Aegean Shopping Park in Shuang Fu, Chongqing, Hangzhou Binjiang Store of Intime Department Store and other projects.

The first large-scale national tide night market "Meixi Never Sleeps City" settled in Changsha, intending to build a national night market benchmark.

On June 6th, the official micro-release of Meixi City that Never Sleeps will build a national night market benchmark in Meixi Lake International New City and the central plot of Changsha, the super central axis of Meixi Lake, and become the "Datang City that Never Sleeps" in Changsha.

The project covers a total area of about 80 mu and is located in the core area of Meixi Lake, which is located on the top of Zhongtang Station, the intersection of Metro Line 6 and Metro Line 2. Four theme areas will be set up and 150 booths will be planned for catering.

?

Meixi city that never sleeps project renderings.

Lavant Lixing Center may become the first luxury shopping center in Guiyang, and more than 90 international brands have been recruited to settle in.

Lavant Lixing Center in Guiyang will officially open in 2022, and at present, more than 90 international brands have been recruited, including Louis Vuitton, Gucci, Burberry, Balenciaga, Cartier, Bulgari Bvlgari and other luxury brands.

Some analysts said that if all the above brands are opened as scheduled, Lixing Center is expected to become the first luxury shopping center in Guiyang.

Planning adjustment of "K11" complex in Shenzhen Shekou Taiziwan involves New World Art and Culture Square and parent-child shopping mall.

On June 25th, Shenzhen issued a number of planning adjustment notices, among which the construction area of Taiziwan New World Art and Culture Square Project was adjusted from 9,000 square meters to 9,110 square meters; The commercial building area of Taiziwan New World Parent-child Shopping Mall Project has been adjusted from 87,807 square meters above ground to 87,564.95 square meters above ground and 242.05 square meters underground.

The above two projects belong to the "K11" complex project in Taiziwan, Shekou, Shenzhen. The latter will be built by New World Development with an investment of over 10 billion yuan, and the whole project will be completed in stages from 2024. In business, K11 Culture and Art Shopping Center and DiscoveryPark Shopping Mall with the theme of family parenting education were introduced.

Renderings of New World Taiziwan Project

The 458-meter Chongqing Top 100 Shopping Center will open at the end of the year.

On June 18th, Chongqing 100 Building (Chongqing Luhai International Center), the tallest building in Chongqing, was capped with a total building height of 458 meters. In this building, the landmark shopping center, super Grade A office building, super five-star luxury hotel and sightseeing floor are comprehensively built.

Chongqing 100 MALL will open at the end of the year, and 70% of the investment has been completed, and the first store in southwest Galeries Lafayette and the first store in TSUTAYA BOOKSTORE, Japan’s largest chain bookstore, have been introduced.

Chongqing 100 renderings

The TOD project of China Resources Shunde is officially named "Shunde China Resources Landmark Plaza", and 130,000 square meters of Vientiane Meeting will be built.

On June 22nd, it was reported that the TOD project of China Resources Shunde was named "Shunde China Resources Landmark Plaza", and about 130,000 commercial buildings will be built by itself.

On March 2, China Resources Land won the TOD commercial and residential area of Jurong North Station on Foshan Line 3 for 3.86 billion yuan. At that time, China Resources Land revealed that it would build a 370-mu TOD station city, a 500,000-square-meter city surrounded by water, a 130,000-square-meter Vientiane business, a 35,000-square-meter cultural and sports center and a 60,000-square-meter waterfront open park.

Rendering of Shunde Huarun Landmark Plaza Project

Guangzhou Baiyun Intercity TOD project planning approval will build a two-storey business and so on.

On June 28th, the planning of Guangzhou Baiyun Intercity TOD Project was approved. The project will build 11 31-45-storey residential buildings, 5 31-33-storey office and commercial buildings, and another 2-storey commercial building.

Shanghai North Bund signed 30 key projects: the total investment exceeded 10 billion yuan, covering many fields such as commerce and trade.

On June 8th, at the meeting of signing key projects of Shanghai North Bund and optimizing business environment, Hongkou District Government signed contracts with 30 enterprises respectively to promote a number of high-quality projects to settle in Hongkou.

This time, 30 key projects were signed, with a total investment of over 10 billion yuan (4 projects above 100 million yuan), including a number of high-quality foreign capital, central enterprises and headquarters-based enterprises, covering finance, commerce, science and technology and other fields.

Chinese Real Estate plans to spend HK$ 4.196 billion to rebuild and revitalize London’s commercial flagship 120 Fleet Street.

On June 8, Chinese Real Estate announced that it would spend HK$ 4.196 billion to rebuild and revitalize its flagship project, 120 Fleet Street;, located in the core business district of London, England. And the property will be renamed Evergo Tower to commemorate the glorious history of the group’s merger with Aimeigao Group in the past. The project includes two main buildings: the commercial building RiverCourt and the two-star historical building Daily Express Building.

The demolition project of the above two main buildings is expected to start in the third quarter of this year, and it is planned to build an open pedestrian street on the underground floor to separate the originally connected River Court and the Daily Express Building, create new business opportunities for shops along Fleet Street and revitalize the whole Park Jung Su Street block.

Century Golden Flower rented Xi ‘an Daming Palace Shopping Center for 1.67 billion yuan for 20 years.

On June 17th, Century Golden Flower announced that it had entered into a lease agreement with Shaanxi Daming Palace Investment and Development to lease the commercial property of Xi ‘an Daming Palace Shopping Center. The agreed building area for rent calculation is 167,300 ㎡, and the lease period is 20 years, with a total rent of 1.67 billion yuan (including tax).

Shanghai Bailian Xijiao Shopping Center will be closed on June 15th and will be upgraded and returned next year.

From 21: 30 on June 15th, Shanghai Bailian Xijiao Shopping Center officially closed its business, and will be renovated and renovated in the form of overall closing. It is expected to be upgraded next year. After the transformation, the western suburbs of Bailian will increase the proportion of experiential merchants such as cultural and creative arts, life experience and scene socialization to meet the needs of business people in Hongqiao International Central Business District and Hongqiao Airport Economic Park, and create an organic and healthy "slow life circle".

As the first open community shopping center in China, Shanghai Bailian Xijiao opened in 2001. The project is located in xin jing, Changning District, Shanghai, with a total volume of 110,000 cubic meters and a commercial volume of nearly 70,000 cubic meters.

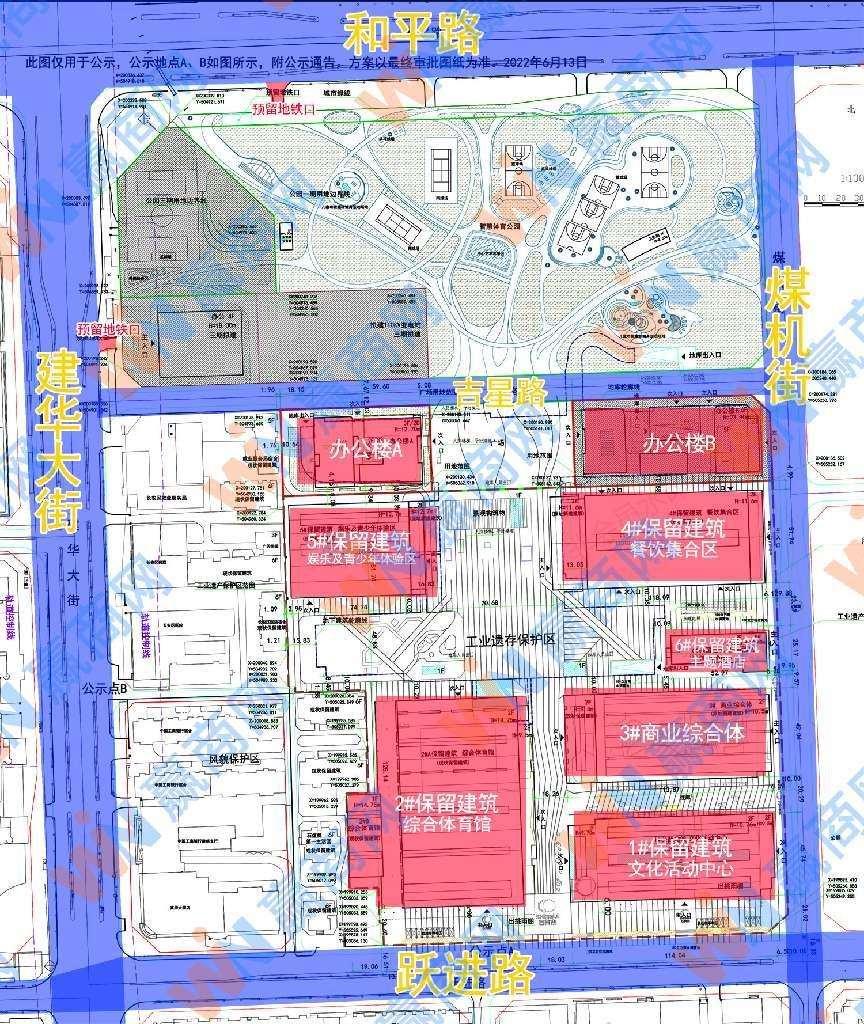

The old factory turned into a commercial complex, and the planning of Shijiazhuang stone coal machine industrial heritage protection zone was exposed.

On June 14th, the Natural Resources and Planning Bureau of Shijiazhuang City issued the Notice on the Publicity of the Design Scheme of the Phase I Project of Shimeiji Urban Renewal Project before Approval, which mainly involved the detailed planning of the industrial heritage protection area, and made it clear that the total land area of the Phase I project of Shimeiji Urban Renewal Project was 66,956.53 square meters. In the future, the stone coal machine industrial heritage protection zone will become an urban complex integrating shopping, catering, sports, cultural activities, youth experience activities, theme hotels and other formats and functions.

As the first batch of old city reconstruction projects that thoroughly implement the "subtraction within the second ring road", its more important significance lies in providing reference for the reconstruction of old factory areas such as Mian Yi Mian Er, Huayao, Shijiazhuang and Coking Plant with larger volume in the later period.

Project planning of the first phase of urban renewal project of stone coal machine

The starting price of the three-beat streaming auction of Dabieshan City Square in Lu ‘an is 640 million yuan.

On June 9th, the Ali asset auction platform showed that the real estate and accessories of commercial and office projects under construction in Dabie Mountain City Plaza (Jiadi MALL) in Jiading District of Lu ‘an had been auctioned, with a starting price of 640 million yuan. On March 2, the first auction of Dabieshan City Plaza in Lu ‘an was auctioned, and the starting price exceeded 800 million yuan. On April 6, the second auction of the project was aborted, and the starting price dropped to 640 million yuan.

The project has a total investment of 1.36 billion yuan and a total construction area of 300,000 ㎡. Planning Sanli Pedestrian Street, Shopping Center, Hotel Group and SOHO Office, it is planned to build a leading commercial complex of cultural tourism in Lu ‘an. The pre-sale permit for the project began in 2016, and the project was shut down for reorganization due to financial problems; After the reorganization of the project in 2019, it was impossible to resume work due to equity disputes and other issues; In August, 2021, the official announced that Lu ‘an Jiadi City Plaza was determined to be bankrupt and liquidated.

The evaluation price of the third auction of Qingdao Belle Plaza is about 333 million yuan.

At 10 o’clock on the morning of June 12, the third auction of Qingdao Belle Plaza ended in a auction again because no one bid.

In 2018, Qingdao Belle Plaza announced its closure. In 2019, the Beijing No.3 Intermediate People’s Court issued an auction announcement of some subject matter in the west area of Belle Plaza, with a selling period of 60 days; The last two were sold from April 13 to June 12, with a price of about 333 million yuan, both of which were auctioned off.

Vanke’s 2.3 billion shares in Baishizhou Old Reconstruction Project Phase III and Phase IV are the largest urban renewal projects in Shenzhen.

On June 7th, Lvjing China announced that Vanke had invested 2.3 billion yuan in the Shenzhen Baishizhou old renovation project under the company. After the subscription is completed, Vanke will hold 8% equity of Sida Industry, the controller of Baishizhou Old Reconstruction Project Company, and the equity of Lvjing China will be diluted from 100% to 92%. Vanke only participated in the third and fourth phases of the project, and distributed 20% and 80% of the profits with Lvjing China respectively.

Baishizhou Old Renovation is located in the rich area of Shenzhen Nanshan Overseas Chinese Town. It is the largest, most concerned and most representative urban renewal project in Shenzhen, with a total area of 460,000 square meters and a total capacity of 3.58 million square meters.

Kaisa’s 30 billion Dongjiaotou project has been transferred to Zhongxin City.

On June 30th, Shenzhen South Shandong Jiaotou Project was officially transferred to CITIC Chengkai, which is the largest equity item in Kaisa’s asset disposal list. The company that took over the above-mentioned projects is Shenzhen Chengkaixin Bank Investment Co., Ltd., a wholly-owned subsidiary of Western Trust, and its legal person is Liu Xing, the chairman of CITIC Chengkai Shenzhen Company.

Dongjiaotou plot covers an area of 171,800 square meters, and the original planned construction area is not less than 310,000 square meters. The latest rights and interests of this lot are nearly 30 billion yuan.

Wen LV

Beijing Universal Resort resumed operation in stages on June 24th, and the theme park was opened on June 25th.

At the beginning of June, affected by the epidemic, Beijing Universal Resort continued to be closed, and the pre-sale of tickets for Beijing Universal Studios theme park, which was originally planned to start on June 11, was postponed.

On June 23rd, Beijing Universal Resort officially announced that it will resume operation in stages from the 24th. Among them, Beijing Universal Studios Theme Park officially opened on the 25th.

Shanghai Disneyland resumed operations on June 30, and shops and restaurants resumed operations on the basis of current restrictions.

On June 10th, Shanghai Disneyland Xingyuan Park, Disney World Store and Blue Sky Avenue resumed operation.

On June 16th, it was the sixth anniversary, and Shanghai Disneyland Le Town and Paradise Hotel resumed operation.

From 7: 00 on June 29, tickets for Shanghai Disneyland will be re-sold; From 13: 00 on the same day, the admission appointment of the annual card was restarted. On the 30th, Shanghai Disneyland officially resumed operation. At the beginning of the resumption of operation, most of the scenic spots, amusement projects, entertainment performances, shops and restaurants in Shanghai Disneyland will resume operation on the basis of current restriction.

Kaisa withdrew from the western trust of Shenzhen Dapeng 30 billion cultural tourism project

On June 21st, according to the enterprise investigation, Kaisa Group withdrew its foreign investment, and the investment enterprises were Shenzhen Jiafu East Tourism Development, Zhaofude Tourism Development and Jiademeihuan Tourism Development, all of which held 51% shares before withdrawal. 51% of the shares of the three companies were taken over by Shenzhen City Kaixin Bank, a subsidiary of Western Trust.

These three companies are responsible for developing the joint venture development project of Kaisa Dapeng Xiasha, which includes Kaisa’s Jinshawan International Park in Dapeng, Shenzhen and Marriott Hotel. Among them, the sub-project Kaisa Jinshawan International Park is expected to have a total investment of 30 billion yuan, and plans to build five major venues, such as the Ice and Snow Pavilion and the Water Park. After completion, it is expected that the annual tourist capacity will reach 5 million.

Planning renderings of Kaisa Jinsha Bay International Paradise?

Zigong Fangte Dinosaur Kingdom opened on June 18th, and Fangte’s brand-new animation sci-fi theme park "Wild Continent" landed in Taizhou.

On June 18th, Sichuan Zigong Fangte Dinosaur Kingdom was opened. As the largest dinosaur theme park in China, the project has 10 large-scale indoor high-tech theme projects and nearly 30 outdoor amusement projects. The total investment of the project is 3 billion yuan, covering an area of 400,000 square meters. It is estimated that the park will attract more than 3 million tourists every year after its opening.

On June 20th, Huaqiang Fant launched a brand-new animation and sci-fi theme park brand-"Fant Wild Mainland" in Taizhou, Zhejiang. The project covers an area of more than 400,000 square meters with a total investment of 3 billion yuan; At present, the project has been fully completed, entered the joint testing stage, and is about to open for guests; It is estimated that after the official operation, it will attract more than 3 million tourists every year.

The second phase planning of Shenzhen legoland Resort was publicized, and the Shanghai Lego supporting commercial street project was signed.

On June 13th, Dapeng Administration of Shenzhen Planning and Natural Resources Bureau publicized the general plan of Shenzhen legoland Resort Project Phase II (Lego South Plaza). The second phase of the project is located in the new large area of Nan ‘ao Street in Dapeng New District, with a land area of 533,400 square meters and a construction scale of 267,000 square meters, including 186,900 square meters of amusement facilities, 14,000 square meters of commerce and 66,100 square meters of other supporting facilities.

On June 30th, the contract for the transfer of plot 01-C-01, Unit FJ010303, Fengjing Town, Jinshan District, Shanghai was successfully signed, and it was won by Binfenli Construction, with a land price of 214.25 million yuan. The above-mentioned project is located in the center of the core area of legoland, with a land area of 81,525.3 square meters. It is planned to build a commercial facility integrating entertainment, catering, leisure and culture. It is estimated that construction will start in the fourth quarter of 2022 and be open to the public in the fourth quarter of 2024.

The strategic cooperation between Haichang Ocean Park and OCT Happy Valley focuses on "Altman" IP.

On June 21st, Haichang Ocean Park announced that it had signed a strategic cooperation agreement with Happy Valley Culture, a subsidiary of OCT Group, and the two sides would cooperate in retail business. According to the agreement, Happy Valley will open its eight Happy Valley projects to Haichang Ocean Park at the same time and introduce the Ultraman Super Energy Station project in Haichang Ocean Park; Haichang Ocean Park is responsible for providing standardized ultraman super energy station products and commodities. Obviously, the focus of this cooperation lies in the IP of "Altman".

On the 27th, Haichang Ocean Park announced that Shanghai Haichang Culture, a wholly-owned subsidiary of the Group, had recently signed a license agreement with Shanghai Xinchuanghua, concerning the use of the "Altman" series of works in the national paid scenic spots to carry out the project of the Altman Energy Station.

Land

The first batch of 36 plots of land in Shanghai collected 83.47 billion yuan for investment and Shekou (001979) collected 16.945 billion yuan for 4 plots.

On June 8, 2022, the first batch of centralized land supply in Shanghai closed, and a total of 36 plots were successfully sold, with a total turnover of 83.47 billion yuan. Among them, China Merchants Shekou seized 4 plots, ranking first in the number of land acquired, spending 16.945 billion yuan.

Shanghai Yangpu Riverside 2.526 billion yuan to sell commercial land requires the introduction of the first store, flagship store and so on.

On June 24th, Mengxiang Qiangyin Culture Communication, together with Shanghai Yangpu Riverside Investment and Development and Lianke Shenhuo Network Technology, won the bid for plots M1-04, M2-01 and M3-01 of Unit N090603 in Dinghai Community, Yangpu District (block 85 of Daqiao Street).

The transfer area of the plot is 42,447.9 square meters, which requires the active introduction of the first store and flagship store, and the overall layout of the business should be made in combination with the business travel service needs of the public areas along the riverside.

The starting price of a commercial land in the starting area of Guangzhou Tianhe Financial City is 1.316 billion yuan.

On June 22nd, the plot AT091002 in the starting area of Guangzhou Tianhe Financial City was put up for sale. The total area of the plot is 5,336.94m2, and the initial listing price is 1.316 billion yuan. The purpose is that commercial land B1 is compatible with commercial land B2; The transfer period is 50 years for comprehensive or other land use, and 40 years for commercial, tourism and entertainment land use.

According to the transfer conditions, the industrial format of the developed project needs to be financial industry and scientific research and development; Total investment of the project 4 billion yuan.

Vanke’s 4.693 billion yuan bid for the "best plot" of the second centralized soil auction in Dongguan requires the construction of 30,000 cubic meters of commercial property.

On June 24, in the second batch of centralized land supply in Dongguan, Vanke won the Guangfa South plot in Nancheng Street for 469,330,300 yuan.

This parcel is in the planning category of "one heart, two axes and three areas" in the central city, with a construction area of 226,968.61 square meters, and the land use is R2 second-class residential land +C2 commercial and financial land +C3 cultural land; It is required to build a commercial property with a floor area of not less than 30,000 square meters free of charge, and the cultural house and the remaining commercial house after free construction are 100% self-sustaining.

Capital

Wanda Commercial’s US dollar debt due in July 2023 rose to 78.5 cents, the biggest increase in two months.

On June 7, Wanda Commercial’s US dollar bond "DALWAN6.87507/23/23" with a coupon of 6.875% due in July 2023 was the biggest increase since March 31, with an increase of 1.4 cents to 78.5 cents per US dollar.

Sun Hung Kai Properties set another record! Signed a HK$ 20.7 billion loan linked to sustainable development performance.

On June 15th, Sun Hung Kai Properties signed a five-year sustainable development performance-linked loan agreement with 16 major international and local banks. This syndicated loan was oversubscribed by more than four times, and the final total loan amount reached HK$ 20.7 billion, which is the largest sustainable development performance-linked loan in Hong Kong’s real estate industry.

Last November, Sun Hung Kai signed a HK$ 8.65 billion sustainable development performance-linked loan, setting a record for the Hong Kong market at that time.

New World Development plans to issue PNC3 USD green and sustainable capital security with an initial guide price of 6.50%.

On June 8th, New World Development plans to issue Reg S, a USD-denominated guaranteed perpetual capital security with an initial guide price of 6.50%.

China Resources Group reached a comprehensive strategic cooperation with Industrial Bank (601166), which provided an overall credit of not less than 70 billion yuan.

On June 10th, Industrial Bank and China Resources Co., Ltd. signed a comprehensive strategic cooperation agreement, intending to provide China Resources Group with an overall credit of not less than 70 billion yuan to jointly promote in-depth cooperation in industrial finance.

Hangzhou Xiaoshan Wanxianghui 2.082 billion yuan ABS successfully issued is the first phase of China Resources Land Wanxianghui 8 billion yuan ABS.

China Resources Land, as a liquidity support institution, maintenance promise and preemptive right holder, successfully issued the "CITIC Jinshi-China Resources Land Vientiane Phase I Asset Support Special Plan" in Shenzhen Stock Exchange. The storage scale of the project is 8 billion yuan, the first phase is 2.082 billion yuan, and the target property is Wanxianghui, Xiaoshan, Hangzhou.

Hesheng Commercial 3.7 billion yuan ABS received feedback from Shenzhen Stock Exchange.

On June 29th, Shenzhen Stock Exchange disclosed that the project status of Bohai Huijin-Hesheng Commercial Property Asset Support Special Plan was updated to "Feedback". The bond category of this issue is ABS, and the proposed issue amount is 3.7 billion yuan.

Su Gaoxin Yongwang Mengle City 1.3 billion yuan ABS received feedback from Shanghai Stock Exchange.

On June 15th, the Shanghai Stock Exchange disclosed that the project status of Huajin Securities-CITIC Securities (600030)- Su Gaoxin AEON Mengle City Asset Support Special Plan was updated to "Feedback". The bond is ABS, and the planned issuance amount is 1.3 billion yuan.

1.1 billion yuan ABS of Chengdu Heshenghui Plaza received feedback from Shanghai Stock Exchange.

On June 24th, the Shanghai Stock Exchange disclosed that the status of Chengdu Heshenghui Plaza asset support special plan project has been updated. The project is issued by ABS, with a planned issuance amount of 1.1 billion yuan.

[enterprise]

Annual Report of Leading Exhibition: Hong Kong’s property income rose against the epidemic, and the rent of Shanghai Vanke Qibao Plaza rose the fastest.

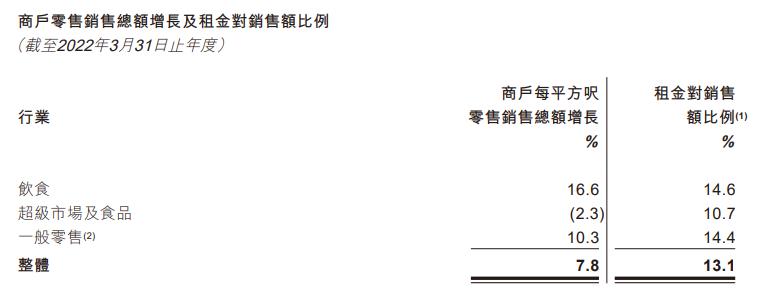

According to the annual performance report of the Leading Exhibition House Trust as of the end of March 2022, the company’s income and net property income increased by 8% and 6.5% year-on-year respectively to HK$ 11.602 billion and HK$ 8.776 billion.

Among them, the rental income of retail properties in Hong Kong was HK$ 6.223 billion. Although the COVID-19 epidemic in The 5th Wave brought challenges to Hong Kong businesses in early 2022, the retail rental rate in Hong Kong increased from 96.8% to 97.7%. The rental income of retail properties in China Mainland was 1.061 billion yuan, and five wholly-owned properties in the Mainland still recorded an 8.8% renewal rent adjustment rate, among which the renewal rent adjustment rate of Shanghai Qibao Vanke Plaza was as high as 27.5%.

The growth of retail sales of leading merchants and the ratio of rent to sales are taken from the annual report of leading merchants.

From January to May, Xincheng Holdings’ total business income was 3.9 billion yuan, and its rental income in May was 722 million yuan.

On June 9, Xincheng Holdings (601155) released its business briefing in May, showing that the company’s total business income from January to May was 3.9 billion yuan; In May, the rental income was 722 million yuan (including rent, management fees, parking lots, diversified businesses and other sporadic management fees).

Yuexiu Real Estate Fund is expected to reduce the total rent for some tenants by 80 million yuan, accounting for 4.5% of the annual income in 2021.

On June 10th, Yuexiu Real Estate Trust announced that it would provide temporary rent relief to several tenants of office buildings, retail malls and wholesale malls held by the company. It is estimated that the total rent relief will be 80 million yuan, accounting for about 4.5% of the company’s total revenue in 2021.

Baolong Commercial terminated its acquisition of Building 7 of Shanghai Bao Yang Baolong Plaza.

On June 6th, Baolong Commercial announced that it was difficult for the Group to obtain the consent of the lessee for taking back the vacant possession of the property for its own use after the completion of the transaction, and in view of the current market environment and recent fluctuations in the capital market, it was decided to voluntarily terminate the transaction under the agreement.

On May 11th, Baolong Commercial announced that it planned to acquire an office building in Shanghai from Baolong Holdings at a cost of 868 million yuan.

Xuhui Commercial announced the full opening of light asset cooperation, and Xuhui Group adjusted some regional organizational structures from July 1.

On June 20th, Xuhui Commercial announced that it would start the light asset cooperation in an all-round way, including entrusted management, operating income sharing, joint venture and co-creation, focusing on Shanghai, Beijing, Chengdu, Changsha and other core cities, and Shanghai will be the key city for Xuhui Commercial to break through the light asset business.

Xuhui will adjust the organizational structure of some regions from July 1, and the Henan business department will be adjusted to Zhengzhou City Company and merged into Huazhong Regional Group; Guangxi Division was reorganized into Nanning City Company and merged into Southeast Regional Group; Fuzhou City Company and Xiamen City Company are integrated into Fuxia City Company.

China Shipping Real Estate launched a new round of organizational restructuring, and the first list of the four major regions was released.

On June 30th, it was reported that China Overseas Real Estate was quietly launching a new round of organizational restructuring:

Regional companyOn the other hand, the North China region merged with the North China region to establish a new North China regional company; Qingdao City Company and Yantai City Company, which originally belonged to the northern region, were included in the East China region, and the platform in the northern region was directly cancelled; Zhengzhou Company, Wuhan Company, Taiyuan Company under the jurisdiction of North China Region and Changsha Company under the jurisdiction of South China Region merged into the western region of China Shipping and established a new regional company in the central and western regions.

City companyOn the other hand, Changchun City Company merged with Harbin City Company to form Changchun District Company; Guangzhou City Company merged with Foshan City Company to form Guangzhou District Company.

Personnel aspectIt has also been adjusted accordingly. The newly released list of the top four districts is: Cheng Xin is in charge of North China, Liu Huiming is in charge of East China, Liu Changsheng is in charge of Central and Western China, and Liu Xianyong is in charge of South China; Li Yingjun, the former head of the western region, was transferred to East China and reused; Xue Fei, the former head of investment in the northern region, was transferred to the new central and western region to continue to manage investment.

Vanke Shareholders’ Meeting: Yu Liang delivered the industry confidence goal and fulfilled the promise of stabilizing this year’s performance.

On June 28th, at Vanke’s 2021 shareholders’ meeting, Chairman Yu Liang gave three key words: the short-term market has bottomed out, the market recovery is a slow and gentle process, and enterprises concentrate on doing their own thing. No matter how difficult the future road is, there will be opportunities if we go on, and the real estate industry will still make due contributions to the country.

President and CEO Zhu Jiusheng made it clear that he would use more active sales and more specific responses to fulfill his promise to stop falling and stabilize his performance this year.

Hongyang responded to the evacuation from Shanghai: the headquarters has been in Nanjing, but some employees are working in Shanghai.

On June 10th, in response to the news that "Hongyang Real Estate, which started in Nanjing, is officially preparing to move back to the base camp, and will end the dual headquarters strategy of Shanghai and Nanjing", Hongyang Real Estate said that its headquarters has been in Nanjing, but there are still employees working in Shanghai.

Mo Bin, president of Country Garden, denied that before the end of the year, the company had no plans for large-scale regional merger.

Since April, the real estate circle has been spreading that Country Garden will undergo a large-scale regional merger.

At Country Garden’s monthly management meeting in June, in response to the above news, Mo Bin, president of the company, denied that Country Garden had no plans for large-scale regional merger before the end of this year.

China Evergrande said that it would strongly oppose the liquidation petition, and it is expected that the petition will not affect the reorganization plan or timetable.

On June 20th, Evergrande Group, Evergrande Property and Evergrande Automobile announced that all three companies had received the resumption guidelines issued by the Hong Kong Stock Exchange on the 15th. Evergrande Group also indicated that it is actively promoting the restructuring work. As announced by the company on January 26th, it is expected that the initial restructuring plan will be announced before the end of July.

On June 24th, a company located in Samoa Island in the Pacific Ocean (601099) filed a liquidation petition with China Evergrande Group in the Hong Kong High Court. The petitioner is represented by Lian Haomin, a strategic investor of Evergrande’s RV Bao. This petition involves the financial obligations of Evergrande amounting to HK$ 862.5 million; The hearing is scheduled for August 31.

On June 28th, China Evergrande announced on the Hong Kong Stock Exchange that it would strongly oppose the petition. It is expected that the petition will not affect the company’s restructuring plan or timetable, and it is planned to announce the preliminary plan for overseas debt restructuring before the end of July.

[personnel changes]

Wanda Real Estate: Zhang Lin took over Qi Jie as the chairman and Huang Guobin as the new director and general manager.

On June 12, according to the enterprise investigation, the main members of Wanda Real Estate Group Co., Ltd. changed, Zhang Lin was adjusted from director and general manager to chairman, and Qi Jie resigned as chairman; Huang Guobin was added as director and general manager.

Hongyang Real Estate: CEO Yuan Chun resigned as Chairman of the Board of Directors and Zeng Huansha took over.

On June 30th, Hongyang Real Estate announced that Yuan Chun had resigned as executive director and chief executive officer because he would allocate more time to personal affairs. At the same time, Zeng Huansha, Executive Director and Chairman of the Board of Directors, has been appointed as the Chief Executive Officer.

Leading exhibition: Tan Chengyin is the chief enterprise development president, and Zhu Haiqun is the managing director of China Mainland.

On June 1st, the manager of the REIT announced the appointment of three senior managers: Tan Chengyin as the chief enterprise development president, Zhu Haiqun as the managing director in China Mainland and Lin Dingbang as the chief investment director (strategic investment).

Wen Jiebang, vice president of Longhu Group, was in charge of Longhu’s innovative business before leaving the company.

On June 14th, Wen Jiebang, vice president of Longhu Group, left his post. He was mainly responsible for Longhu’s innovative business.

Wen Jiebang is a Ph.D. student from Zhejiang University. After graduation, he joined the "official student" system in Longhu, and served as vice president of Longhu Group and general manager of Longhu Shanghai Company.

Shimao Group: Appointed Executive Director and Vice President Lu Yi as CEO.

Shimao Group announced the appointment of Lv Yi, executive director and vice president of the company, as the CEO, which will take effect on June 23rd. At this point, Lu Yi will be the executive director and CEO of Shimao Group.

Kerry Construction: Lan Xiulian, Executive Director and Chief Financial Officer, resigned and Qu Qinglin temporarily took over.

On June 30th, Kerry Construction announced that Lan Xiulian, executive director and chief financial officer, resigned, which will take effect on August 31st. Before the new chief financial officer takes office, the deputy chief executive and executive director, Mr. Qu Qinglin, will temporarily take over.

Lin Longan, Chairman of the Board of Directors of Yuzhou Group, resigned as his wife and Guo Yinglan took over.

On June 24th, Yuzhou Group announced that Lin Longan had resigned as Chairman and CEO of the Board of Directors due to the adjustment of work arrangement. At the same time, Lin Longan’s wife Guo Yinglan was appointed as the chairman and CEO of the company.

He Jingtai Fu has joined a group of famous enterprise managers: Tang Yang, general manager of North China, and Yang Lin, general manager of Shenzhen. …

He Jingtai Fu recently joined a group of famous enterprise managers: On June 14th, He Min, who served as the vice president of Longhu Group Marketing Center, became the new general manager of He Jingtai Fu Group Marketing.

On June 13th, Tang Yang, who served as general manager of Longhu Sunan Company and co-general manager of Hesheng Chuangzhan Commercial Construction Company, became the new regional general manager of Hejingtai Fuhua North China; Yang Lin, who has served as vice president of Country Garden Shenzhen and Hongyang Guangdong Company, is the new regional manager of Hejing Taifu Shenzhen.

At the end of May, Yang Baogang, vice president of Longhu Group Engineering, joined Hejing Taifu as the general manager of the Group Engineering Center.

At the end of March, Gao Wei, an official student from Longhu, joined Hejing Taifu as the general manager of Southwest China.

Liu Wensheng, Deputy General Manager of Poly Development, resigned

On June 17th, Poly Development announced that Liu Wensheng applied to resign as the deputy general manager of the company due to work adjustment.

Zhou Qing, former CEO of Shangkun Group, joined Zhongnan Group’s brand-new entrepreneurial platform.

On June 22, it was reported that Zhou Qing, the former CEO of Shangkun Group, had joined the new entrepreneurial platform of Zhongnan Group at the end of May this year.

The platform is controlled by Zhongnan Group, with Zhou Qing as the legal person and chairman, which is more like opening a new entrepreneurial road for real estate executives.

Kaisa Group: Wu Jianxin resigned as CFO and Luo Tingting succeeded him.

On June 20th, Kaisa Group announced that Wu Jianxin had resigned as chief financial officer to devote more time to personal affairs. Luo Tingting has been appointed as the chief financial officer.

Haichang Ocean Park appointed Jin Minhao as the president of the Asia-Pacific region, and the latter successively served as the president of Wanda Theme Entertainment.

Haichang Ocean Park announced the appointment of Jin Minhao as the president of the Asia-Pacific region of the Group (except Chinese mainland), effective from June 15th. He will be fully responsible for the expansion, operation and management of the Group’s business in Asia and the landing of intellectual property business.

Jin Minhao has rich management experience in the cultural tourism industry, and has served as the chief executive of Hong Kong Disneyland and the president of Wanda Theme Entertainment Co., Ltd..

Image source: Unless otherwise specified, all of them are from Win Business Network or the official of the enterprise/project.

Content sources: Yingshang.com, Real Estate People’s Talk, Beijing Municipal Bureau of Commerce, Viewpoint.com, Leju Finance, Chengdu Publishing, Interface, Tao Ge Miscellaneous Talk, The Paper, Xinhuanet (603888), Lu ‘an News Network, Time Finance, Wenlv, China Daily, Chengdu Publishing, Real Estate Management, Fujian Daily, Yangguang.com, Time Weekly, Tao Ge Miscellaneous Talk, Fashion Business Daily.